Sprout pricing and plans guide for the UK (2025)

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Typically, a small business, anywhere in the world, is hanging by a thread. One wrong move could bring all your efforts to pieces, with no other option than to quit or start all over again. And let's be frank – both of these options are terrifying. According to a report, 20% of the new businesses in the UK fail during their first year of operations1.

Facts and figures like this clearly indicate the need for careful strategic planning. As a start-up or a small venture, you need a foolproof plan to beat all the odds and thrive in this competitive landscape.

Getting an accounting app in your toolkit brings you a step closer to success. When you delegate the high-end tasks to a reliable accounting tool, you can get accurate calculations. It will relieve you of the complicated arithmetic, allowing you to focus on tasks that require more attention.

This guide compares the top 7 accounting apps available for small businesses in the UK. A closer look at each of these can help you decide which one is suitable for your small business.

And as you examine the apps, make sure to check innovative solutions like Wise Business. This easy-to-use multi-currency account works well with popular cloud accounting software, like Xero, Quickbooks and Zoho Books. It aims to help you manage your business finances in the UK and beyond.

💡 Learn more about Wise Business

Accounting tools have been around for a long time. It's no surprise that you'll be bombarded with choices when finding one for your business. Once you know how to filter the good ones from the dummies, you'll have to evaluate them based on user experience, special features, and add-ons.

Basic online accounting software helps you record income and expenses, shows a simple dashboard to track money coming in and going out, handles sales tax, and gives you useful reports about your business. More advanced tools can also track inventory, give detailed reports, manage payroll, connect with your bank, help with budgeting, and support online selling.

A few factors to determine the good ones are:

User-friendliness is the top criteria when finding an accounting app or software. The design should be easy for users and help them navigate the app swiftly. Apart from the pros, the interface should also be intuitive enough for non-accountants. We recommend options that provide multi-dimensional reporting features. The generated reports should be customized according to your team's needs and goals.

Your business needs accounting software that enables you and your team to work efficiently with customers, suppliers, and banks. It should make it easy to record accounts, check bank balances, manage credit, and keep track of payments and due dates. These tasks are crucial for maintaining your financial stability.

Numbers are usually sensitive data, which cannot be put at any risk. Before picking any accounting software, it’s smart to check if the company behind it is reliable. Review the app’s history and the company's past performance. This can help you feel more confident using it. Also, reading reviews from other users can give you a better idea of what to expect.

A good app for bookkeeping should also include tax features.

This helps employees handle tax tasks more easily. It typically covers VAT and PPh (income tax) calculations and can also print tax invoices.

Not every affordable accounting app is sustainable in the long run. Around 70% of the books are still being done in spreadsheets because it doesn't seem reasonable to subscribe for low-volume accounts or clients for whom the books are done at year-end. At the same time, spreadsheets can also compromise your company's productivity, as most functions are manual, and there is a higher chance of human error.

In short, your business needs an accounting app that delivers the best value for your investment.

For small businesses in the UK, having multi-currency support in a bookkeeping app makes a big difference. It helps you send and receive payments in different currencies without the hassle. It can also keep your reports accurate and save you from manual conversions. If you're dealing with international clients or planning to grow globally, it's a handy feature that keeps things simple and stress-free.

A small business doesn't have a broad margin for error or the luxury of trial and error. A limited budget, high inflation, and even higher competition mean you need to play the right cards from the start.

Below, we have compiled a list of the UK's best accounting apps for small businesses, along with a detailed insight into their key features:

Xero is a powerful accounting app designed for established UK businesses that manage regular billing and complex financial operations. It includes tools for invoicing, bank feeds, expense tracking, and receipt uploads. You can easily assign expenses to clients and track mileage. Projects are shown in three stages: draft, in progress, and complete. These are intended to provide you with a clear view of time, costs, and deadlines.

The platform integrates seamlessly with over 1,000 apps, covering areas such as payroll, CRM, and e-commerce. For instance, you can connect Xero with Wise Business for seamless reconciliation. Further, its AI assistant, JAX (Just Ask Xero), is in beta and aims to simplify tasks through voice commands.

Xero's pricing (excluding VAT) is2:

Xero works well for accountants and finance teams who need advanced tools and deep integrations. The interface can feel outdated, and new users may find the dashboard confusing. It also requires a one-month minimum contract. However, if your business is growing and requires serious functionality, Xero gets the job done.

QuickBooks Online is a cloud-based accounting tool. Like Xero, it is built to support businesses of all kinds. Multiple plans can cater to sole traders and growing companies alike. The Simple Start and Essentials plans are good picks for startups. You can link your QuickBooks account to your business bank or platforms like Wise Business for easy reconciliation.

Next is the Essentials plan. This includes helpful tools like VAT reminders, tax prep support, and the ability to upload receipts, track mileage, monitor employee time, and create customised reports. You can also send invoices, manage bills, and work with different currencies. If you need payroll features, you can add them to most plans starting at just £1 per month.

Although there is a learning curve for new users of accounting tools, QuickBooks provides solid support along the way. Note that it doesn't include built-in time tracking for billable hours. You'll need QuickBooks Time for that, but it makes up for it with a strong feature set. Integration with tools like Zapier means you can automate tasks and connect with thousands of other apps.

Here's the updated pricing policy for this app3:

UK-based FreeAgent is another app that's known for its value for money. It features scenario prediction tools and tax timeline capabilities that can help maintain the financial health of a budding venture. The cash flow alerts featured in this app keep you in the loop about potential shortfalls and surpluses. Meanwhile, its timeline feature for invoicing can make things clear and easily trackable.

We all know how a small business needs to watch all the nitty-gritty of its finances (the bigger ones aren't an exception either). And FreeAgent facilitates this need with its detailed end-of-year reports. You can gain a clear view of your finances and streamline your operations moving forward.

FreeAgent does a great job of keeping things simple without cutting corners. Unlike Xero, which is suited for more advanced users, FreeAgent is easy to get started with and still offers powerful tools to manage your business smoothly.

Check out its updated pricing list below to determine its viability with your budget4:

All plans include a 30-day free trial and comply with HMRC's Making Tax Digital requirement. FreeAgent also integrates with Wise Business account for seamless account reconciliation.

Like Intuit, Sage has been in the market since the 80s. It's a massive company that offers accounting plans for businesses of all sizes, whether they're small ventures or large corporations. For those looking to establish their brand identity, Sage brings themes and branded tools that can help them stand out. It customizes the reports and documents on the users' behalf so they can represent their themes, logos, and fonts.

The invoicing and quoting process stands out for being modern and user-friendly. Both product and service-based businesses can benefit from Sage's smooth invoicing features. Its detailed dashboard is one of a kind. You can preview the forecasts, cash flow statements, and account balances. This makes it possible to be keen on financial planning.

Unlike many other tools that offer free mobile apps for capturing receipts, Sage charges for this feature through its AutoEntry add-on. However, it does more than just scan receipts. Once data import rules are set up, you can upload various documents, and Sage will sort, extract, and store the information for easy access. It goes beyond basic receipt capture, making it a valuable option for anyone managing lots of paperwork.

Now, let's take a look at Sage Accounting (UK) pricing plans5:

These are the core plans for UK-based small businesses. Additional Sage products (like Sage Intacct or Sage 200) use custom pricing.

Zoho brings a powerful software suite to the table. It seems that the company cares as much about quality as it does about quantity. Its bookkeeping arsenal includes project tracking, time logs, and inventory management. Each page indeed contains a lot of information and fields. Things become easier with regular use.

Businesses can also use the budgeting feature to set spending limits on selected accounts, even assets, liabilities, and equity. Although it doesn't feel like a personal finance app, it suits business budgeting needs well. The reports section offers a good variety and lets users customize layouts and save favorites for quick access.

The accounting features cater to both business owners and accountants. There is a section specifically for tracking tax payments and adjustments, as well as a journal to record other key financial events. Zoho Books also connects with Wise Business so you can easily reconcile your account.

What makes Zoho Books stand out is how well it blends documentation, inventory tracking, and daily financial tasks into one clean, user-friendly platform. The layout is modern and intuitive, making navigation easy and quick. Even on the go, the mobile app helps you monitor your finances in real-time. For small businesses seeking efficient tools without complexity, using Zoho Books can be a lifesaver.

Here's a detailed look at its current pricing plan6:

All plans include a 14-day free trial, allowing users to switch between plans or cancel at any time.

Kashflow is the accounting software that's been providing cloud-based accounting services to UK businesses since 2005. It takes pride in how its simple interface combines with modern accounting solutions to help businesses. It was primarily designed for UK businesses and is, by far, one of the best apps for small business accounting.

It offers a wide range of tools that go beyond basic bookkeeping, including payroll and HR features. The app is beneficial for small businesses dealing with VAT, thanks to helpful features like color-coded VAT returns and an easy-to-use VAT dashboard. This makes tracking your tax obligations simpler and more transparent. The progress bars also help you quickly see how far you are through essential tasks.

KashFlow's modular setup lets you add payroll and HR tools as needed, making it a flexible app for bookkeeping and managing your business operations. It also handles expenses, contact management, and fixed assets smoothly.

At the heart of KashFlow is its Dashboard, which brings all the essential features and information together in one place. The layout helps small business owners stay organized and in control throughout the year. Needless to say, KashFlow is a strong choice if you're looking for an app that covers everything your small business needs for bookkeeping.

Here are the updated monthly pricing plans for KashFlow in the UK7:

These plans include a 14-day free trial and are billed monthly, with no long-term contract required.

FreshBooks is another competitive tool that’s good for a business in its initial stages. The integrated chatbot is available 24/7, allowing you to seek help from the bots behind the scenes at any time of day. Its easy-to-use interface is also helpful for newer or less experienced businesses, including sole traders. The navigation bar is neatly arranged, and each feature is clearly labeled. All of this makes it simple for users to find and use the tools they need without any hassle.

It may not have a full-fledged accounting setup, but it includes all the core features you need. The precise time tracking for billable hours is not included in all apps. You can convert these into invoices directly from the projects folder.

You can set up automated invoices, including recurring ones, so you don’t have to worry about sending them manually each time. It also helps with tracking expenses by automatically pulling in bill and receipt details. For quick reconciliation you can connect Freshbooks with your Wise Business account. Clients can pay using different methods, which makes the whole process smoother. When it comes to finances, you can quickly generate reports and even submit MTD-compliant VAT returns straight to HMRC.

Here's the updated pricing list for FreshBooks UK8:

The app may sometimes offer discounts to new subscribers. Watch for them to avail while you check how it fits your business structure.

| Business Type | Recommended Software | Why It’s a Good Fit |

|---|---|---|

| Freelancers, Sole Traders | FreeAgent, FreshBooks | Simple interfaces, built-in time tracking, and features tailored to solo users. FreeAgent is free with certain UK bank accounts. |

| Micro-Businesses (1–5 employees) | QuickBooks Online, Zoho Books | Affordable plans, easy invoicing, good automation, and strong support for basic payroll and VAT returns. |

| Growing Small Businesses | Xero, Sage Accounting | Scalable features, solid reporting tools, inventory tracking, and strong integrations with other UK-based tools and banks. |

| Retail or Inventory-Based Businesses | Xero, Zoho Books | Built-in stock/inventory management and multi-currency support. Xero integrates well with POS systems. |

| Service-Based Businesses | FreshBooks, QuickBooks Online | Time tracking, project management, and recurring billing options make them ideal for agencies or consultants. |

| VAT-Registered Businesses (MTD compliant) | Sage Accounting, Xero, QuickBooks Online | All are MTD-compliant and support direct VAT submissions to HMRC. |

Pro Tip: Take your time to explore the free trials and see which one feels right for your work style.

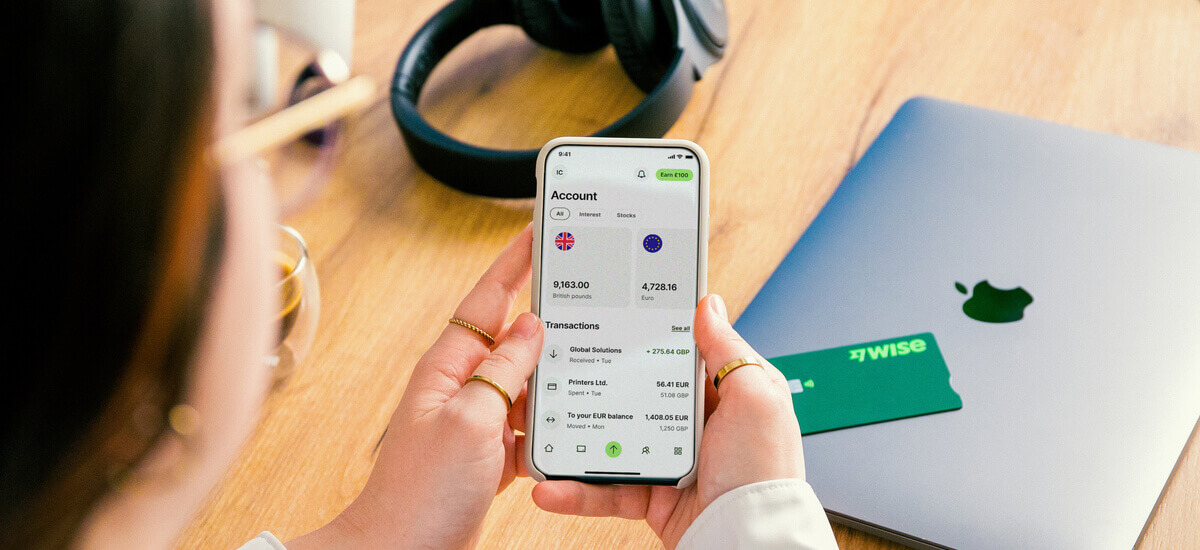

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

Wise Business account connects with Xero, QuickBooks, FreeAgent, FreshBooks and more solutions to help you seamlessly manage your finances across borders.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

Small businesses typically choose between two primary methods for handling their accounting: the cash basis and the accrual basis. Both come with their own benefits and drawbacks. The method you go with will affect your taxes, how your financial reports look, and the choices you make for your business.

Absolutely, yes. Using accounting software can make a big difference in how smoothly and successfully your small business runs. It comes with a lot of helpful features that can really boost your efficiency.

Picking the right accounting software for your small business isn’t always simple. In the UK, the best options for 2025 will offer useful tools like invoicing, VAT handling, and expense tracking. Popular choices include Xero, QuickBooks Online, and FreeAgent. But before you decide, make sure to think about the cost, features, ease of use, and whether it fits your business needs.

Sources used in this article:

Sources last checked 30/06/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Sprout Social's pricing and features. Compare plans and add-ons to find the right solution for your business and optimise your subscription.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn how much tax you’ll pay as a UK sole trader in 2025. Our guide explains what type of taxes UK sole traders pay, when they have to pay them, and more.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.