Can a Sole Trader Have Employees? Rules & Guide

Unsure if a sole trader can hire employees? Learn the rules, legal obligations, and benefits of employing staff as a sole trader in Australia.

Sorting out your Business Activity Statement (BAS) is a key part of running a business in Australia. If you’re registered for Goods and Services Tax (GST), you’ll need to report certain taxes through a BAS. Lodging it correctly helps you stay compliant and avoid penalties, while keeping your business finances healthy.

In this guide, we’ll break down what a BAS is, what to include in one, and how to lodge it. There are also best practices to make the process faster and less stressful.

| Table of contents |

|---|

A BAS is a document submitted to the Australian Taxation Office (ATO) that tracks and reports on the tax a business owes across several tax types¹. All businesses registered for GST must report and pay taxes, such as:

You don’t have to worry about finding a BAS form yourself. The ATO will start sending you a BAS automatically after you get your Australian Business Number (ABN) and register for GST. The ATO notes it will do so “when it is time to lodge.”²

Curious on what is a BAS statement? A BAS statement summarises all of your business’s tax obligations for a specific period: monthly, quarterly, or annually. What you include will depend on your business activity and what needs to be reported — certain items must be disclosed in your BAS.

The most common elements are:

You must disclose all the GST collected on sales during the reporting period, plus any paid on business expenses. There are a few categories of sales you need to include³:

The BAS form has fields for each of these categories, making it easier to file each one and calculate a final, accurate GST figure.

| 👆Read our blog for more information on how much tax a small business has to pay in Australia. |

|---|

PAYG withholding relates to your payroll. It’s when you take a specific amount from one of your employees’ salaries and pay it to the ATO⁴. There are sections to report this in the BAS:

Some businesses are required to pay portions of their expected income tax throughout the year. If your business is on the ATO’s PAYG instalment system, the amounts you prepay are reported and paid in this section of the BAS.

You can either accept the ATO-calculated instalment, which is based on your previous year’s tax, or work out your own income-based instalment for the current period. These payments are credited against your annual tax liability, reducing the amount owed when you lodge your full tax return⁵.

You might have to report other taxes depending on your industry and activities. These include fringe benefits tax (FBT) instalments and luxury car tax. If these aren’t relevant for your business, these sections won’t appear in your BAS.

There are multiple ways to lodge your BAS².

If you’re a sole trader, you can also lodge your BAS using a myGov account linked to the ATO¹.

If you can’t lodge your BAS or pay on time for any reason, contact the ATO immediately to discuss your options⁶. You might be able to get a short extension or a separate payment plan, but only in exceptional cases.

ATO states that businesses with a GST turnover below $20 million can report and pay GST quarterly if they haven’t received a direct request to report more frequently.

The due dates run regularly, every three months, from late October.

Here’s a full breakdown for the quarterly schedule⁷:

Anyone with a GST turnover on or above $20 million must report and pay GST every month. The deadline is the 21st day of each month after the taxable period ends⁷. For example:

Finally, businesses registered for GST voluntarily with a turnover below $75,000 can report and pay once a year⁷. The due date for annual returns is 31 October.

The key to lodging your BAS correctly is structure and preparation. You need systems in place that log all of your records so you have everything on hand when the time comes to file.

Here are six best practices for lodging a BAS⁸.

Keeping all your records organised and up-to-date is arguably the best thing you can do for filing BAS forms accurately. Make sure to track everything — sales, expenses, wages, stocks, logbooks for business travel, etc. Your records should align with bank statements and be retained for at least 5 years.

Always issue proper tax invoices with GST clearly indicated. You’re required by law to provide tax invoices if the purchase is taxable and more than $82.50, including GST. You can also claim GST credits on these.

Use correct formulas, maintain separate GST columns in your cash book, and double-check that all the totals match. Pay special attention to any GST amounts you enter.

You can only claim GST credits on business-related portions of mixed-use purchases for things like internet and fuel. Always calculate GST credits in the Australian dollar (AUD), too, even for foreign currency invoices. And remember to claim any credits within 4 years.

When filling out the BAS report, remember to:

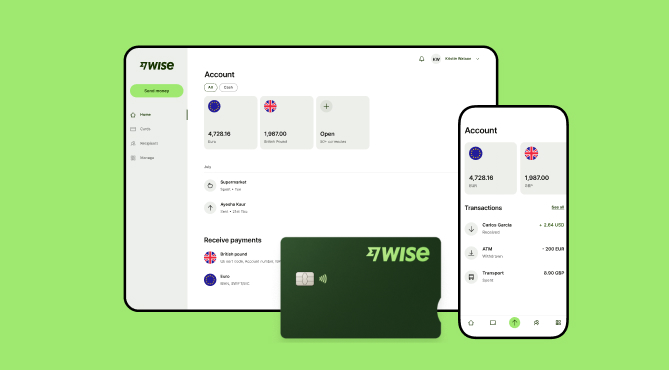

Using integrated accounting software that connects to the ATO via Standard Business Reporting (SBR) makes the process a lot easier. And it reduces manual errors. For instance, integrating your accounting system with tools like Wise Business to simplify tracking income and expenses, especially if you receive or make payments in multiple currencies.

Tracking cross-border payments for your BAS can be a real challenge, especially if you’re dealing with clients or suppliers in other countries on a daily basis.

Wise Business lets you track all of your incomings and outgoings with a suite of tools for managing finances. And you benefit from cheaper international transactions with low fees and no markups.

Our Business account helps by:

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. What is g11 in BAS?

G11 refers to non-capital purchases you’ve made during a reporting period, such as trading stock or running expenses tied to business operations like office supplies, equipment repairs and rentals, and other leases⁹. Any capital items below $1,000 in cost not entered at G10 must also be reported.

2. What is the difference between BAS and IAS?

A Business Activity Statement (BAS) is used to disclose a range of taxes, such as GST or PAYG withholding, if your business has obligations across multiple tax areas. In contrast, an Instant Activity Statement (IAS) is issued to companies that don’t have to report GST or lodge a BAS but do have obligations for PAYG withholding (or income tax instalments)¹⁰.

3. What are BAS W1 and W2?

The ATO defines W1 as the “total salary, wages, and other payments” on which you’re required to withhold tax. This includes things like employee wages and director fees, but not super contributions. Meanwhile, W2 covers the total amount of tax you have withheld from the payments reported at W1.

4. What is the difference between BAS excluded and GST-free?

In the BAS context, GST-free sales are transactions where GST does not apply, such as basic food items or medical services¹¹. But you still need to report them on your BAS at labels like G1 or G3, depending on your reporting method. On the other hand, BAS-excluded items are transactions you do not include on your BAS at all. These include input-taxed supplies like financial services (lending money), where GST is neither charged nor claimable.

5. What is G1 in BAS?

The ATO defines G1 as “total sales,” which includes all your business’s revenue for the reporting period¹¹. This includes GST-inclusive, GST-free, and input-taxed sales. It’s a gross value regardless of whether the sales were taxable or not.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Unsure if a sole trader can hire employees? Learn the rules, legal obligations, and benefits of employing staff as a sole trader in Australia.

Discover if a virtual assistant is right for your business. This guide covers the types of VAs, their duties, managing them, along with the pros and cons.

Read on how Prophit Systems saved up to 9x on global payroll by switching to Wise Business, saving over 10+ hours a month in admin time.

Essential invoice payment terms for Australian businesses. From Net 30 to PIA, discover best practices to improve cash flow and get paid faster. Read now!

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.