Best Small Business Bank Accounts in Australia

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.

OFX is a financial platform that lets you make international payments. It promises to give you “more control” over your finances with multi-currency account features and tools to manage exchange rates and reduce fees.

In this blog, we’ll explore exactly how OFX works. There’s more on features and fees, a guide on creating an OFX business account, and other alternatives to an OFX Business account.

| Table of contents |

|---|

An OFX business account is a multi-currency account designed for businesses that complete international transactions for multiple use cases. Customers can use OFX to receive, manage, convert, and pay suppliers or employees in 30+ currencies.

OFX was founded in Australia, back in 1998¹. The company’s headquarters remain in Sydney, but it now serves over 1 million clients globally. OFX also states that 37,000+ businesses use the platform to streamline their finances².

How does it work? Imagine you’re an Australian e-commerce business sourcing products from suppliers in China, selling to customers in New Zealand, and paying contractors in the Philippines. Traditional banks typically charge big fees for each currency conversion and transfer. OFX promises to do this cheaper and faster, making it easier to manage a global chain of transactions.

The main product is an “all-in-one” global business account to support these cross-border transactions, but there’s a full suite of other useful features.

Here’s an overview of some of the features available with an OFX business account.

You can send business payments to companies or individuals in 30+ currencies to 170+ countries using OFX. This includes all the key markets like New Zealand, the US, the UK, Europe, and Asia.

The cost and limits depend on the type of transaction.

The minimum transfer amount is $250 for international transactions and anything less than $10,000 will incur a $15 transfer fee⁵. There aren’t any maximum limits. OFX says you “send as much currency” as you like⁶. It does recommend checking with your banking partner of choice for any bank-related daily transfer limits.

There are account limitations for domestic transactions, though. The standard Business plan includes 20 transactions per month with a $1 charge per transaction thereafter. Business Plus ups the limit to 200 transactions per month with the same $1 charge outside the allotted allocation⁷.

Now, let’s look at the payment, transfer, and card fees with an OFX business account. All the fees listed are in AUD.⁸

OFX says it takes 1 day to transfer money to a bank account in AUD. The same time frame is given for both funding an account and sending money to a recipient. The timescale can vary slightly for other currencies. For example, EUR and USD are both listed as 1 to 2 days⁹.

The sign-up process for OFX business accounts can be comprehensive where users are required to provide details about the business, with a final step of ‘ID verification’ to get the business account live and ready to send and receive payments.

Here’s a step-by-step guide for opening an OFX business account.

After everything is submitted, an OFX expert will review the application and approve your account within a couple of days.

While OFX has its merits, it’s worth looking at other options to see how they compare and which solution might be the most suitable option for your international business transaction needs (cheaper fees, advanced features etc.)

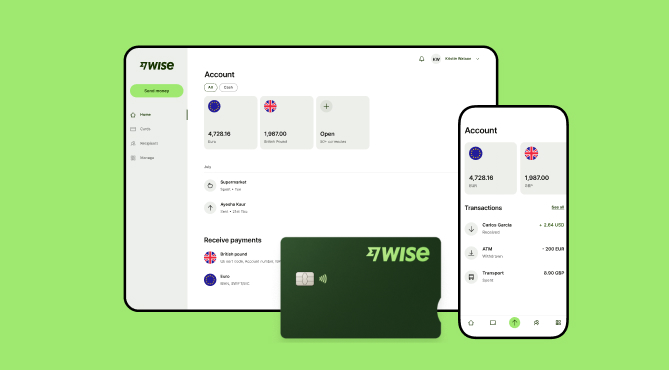

As an alternative business account solution, Wise Business gives business access to multi-currency accounts where cross-currency transfers occur at low transparent fees while also offering a suite of tools to manage your finances and global payroll.

Here’s a side-by-side comparison of the key features and fees between the two business account providers:

| Feature | OFX Business (AUD) 4,5,7 | Wise Business (AUD) |

|---|---|---|

| Account opening | Free | Free |

| Monthly fee | $0 or $15 per user | $0 |

| Minimum international transfer | $250 | $1 |

| Transfer fees | No explicit fees | From 0.63% |

| Currencies support | 30+ | 40+ |

| Local account details | 4 currencies | 8+ currencies |

| Debit cards | Yes | Yes |

| Invoice and payment tools | Yes | Yes |

| Accounting integration | Xero and QuickBooks | Xero and Quickbooks, plus 4 others. |

Wise Business lets you send, receive, and hold money in over 40+ currencies with one account. Select the currency and amount, enter recipient details, choose a payment method, then review and confirm the transfer. Monitor progress through your Wise Business account dashboard with complete visibility over all international payments.

Wise Business solves common cross-border money challenges like:

**Transaction speed claimed depends on individual circumstances and may not be available for all transactions.*

Sign up for the Wise Business account! 🚀

Sending Money with Wise Business

Send money to recipients worldwide with no minimum transfer limits and competitive exchange rates. The platform supports major currencies including New Zealand dollar (NZD), US dollar (USD), Euro (EUR), British pound (GBP), Canadian dollar (CAD), Singapore dollar (SGD), Japanese yen (JPY), and Hong Kong dollar (HKD). Pay suppliers, contractors, and business partners using bank transfers, debit cards, or your existing Wise balance.

Local Account Details for receiving money

Wise Business provides local account details in 8+ currencies, allowing clients to pay you using domestic bank transfers in their local currency. This eliminates international wire fees and reduces processing times. These business account details include account numbers, routing codes, and banking identifiers specific to each country, functioning similar to traditional local business bank accounts.

| British Pound (GBP) | Euro (EUR) | US Dollar (USD) |

| Australian Dollar (AUD) | New Zealand Dollar (NZD) | Singapore Dollar (SGD) |

| Romanian Leu (RON) | Canadian Dollar (CAD) | Hungarian Forint (HUF) |

| Turkish Lira (TRY) |

| 👆For a complete coverage of currencies and countries, check our page here! |

|---|

It’s free to register for a Wise Business account. After you’ve signed up, you can count on competitive prices — we never inflate rates or charges.

Here are some of the common fees to be aware of:

Wise Business is built for global business finances. No transaction is too complex. In fact, you even get a discount when larger transactions exceed $40,000 AUD. Similarly, you can also use for Wise Business for all of your smaller, day to day cross-border transactions to currencies that matter most for your business. While these aren’t as big amounts, but are often just as important.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

1. Does OFX send money directly to a bank account?

Yes, OFX sends money directly to a recipient’s bank account. After submitting the transfer using the recipient’s bank detail, you can track everything online until it’s safely settled. There might be a currency conversion charge.

2. How do you close or deactivate an OFX account?

You can request your account to be deleted by logging into the OFX app and selecting ‘Account deletion’ from the ‘Settings’ menu. OFX will then process your request and close the account¹⁰.

3. Does OFX charge fees when transferring money?

Yes, there are fees depending on the type of transaction. OFX charges a $10 AUD fee for payments made via SWIFT. Other transactions that require a currency conversion are typically ‘free’. However, transferring money to a recipient not using the OFX Australian Business Platform costs $15 AUD for all transactions under $10,000 AUD or the foreign currency equivalent.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.

Is the Remitly business account available in Australia? How does it facilitate global payments compared to alternatives like Wise Business. Read for more info!

Learn what a Stripe account is used for and how to set up a business account in Australia. Explore step-by-step instructions, and international payment advice.

Discover everything you need to know about opening a free business bank account in Australia, from no-fee benefits to comparing free banking options.

Find out how to choose a Business Savings Account and what are some of the best options available in Australia. Read here to find out more!

Want to set up a sole trader business bank account? Learn how separating finances can help your business and explore the best bank accounts in Australia.