OFX Business Account: Features, Fees, Alternatives, & more [2025]

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Remitly is a popular remittance service that serves 170+ countries and territories globally¹. But can you open a Remitly Business Account in Australia in 2025 to pay suppliers or a remote workforce overseas?

In this blog, we’ll answer that questions surrounding Remitly's business account offering and explore alternative solutions for Australian companies.

| Table of contents |

|---|

Sign up for the Wise Business account! 🚀

Remitly is an online remittance service designed to help customers send money to other people overseas. While the term ‘remittance’ is mainly associated with expats and immigrants paying friends and family in other countries, Remitly has recently introduced new features for business use.

Unfortunately, Remitly does not offer business accounts in Australia. The Remitly Business service, which promises to ‘simplify payments’ when paying teams, vendors, or invoices, is currently only available to US and UK-based businesses. The only option to make payments through Remitly in Australia is their personal account service at the moment.

One other big caveat is that you can’t use Remitly to send money from Australia to someone in New Zealand. The support for countries and currencies varies by region.

Yes, but with limitations. You can send money to a business bank account in select countries, provided you have the recipient’s details. However, the transfer limit is AUD 10,000². This is less than ideal if you want to make regular, larger transactions.

Here are a few other things to consider when using Remitly:

Remitly is better suited for very occasional, low-volume transfers. It’s not built for higher-frequency global transactions.

While Remitly does not offer business accounts in Australia, there are several alternative solutions available for those with cross-border business transaction needs. One such option is Wise Business.

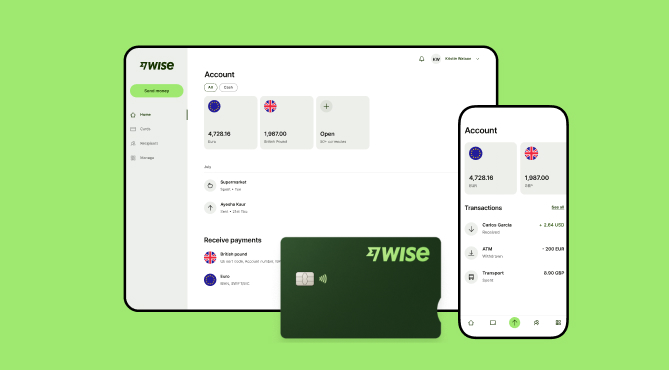

Wise Business offers a multi-currency business account that can be used to hold and manage funds in over 40+ currencies without the need for multiple bank accounts.

Additionally, Wise Business offers currency conversions at low and transparent fees with no hidden markups on the mid-market exchange rates. This allows businesses to get the most value out of their cross border business transactions.

Here’s a short overview on the Wise Business account:

| Feature | Wise Business |

|---|---|

| Account opening | Free |

| Monthly recurring fees | $0 |

| Max international transfer | 5,000,000 AUD |

| Transfer fees | From 0.63% |

| Multi-currency account | Yes |

| Local account details | 8+ currencies (For a one-time fee of 65 AUD) |

| Debit cards | Yes |

| Accounting software integration | Xero, Quickbooks, Zoho Books, FreeAgent, Odoo and more |

| Invoice and payment tools | Yes |

Sign up for the Wise Business account! 🚀

You can send money to 140+ countries with a Wise Business account. Users can just choose the currency and amount, enter your recipient’s details, and pick how the mode of payment. It then gives a clear breakdown of the fees involved before the transfer is made. In addition, users also get to track every step of the transfer right from the dashboard.

For instance, Wise Business account users can send payments to New Zealand and get local business account details to receive money in NZD. Here's are some of the other major currencies where transfers are facilitated with a Wise Business account:

There’s no minimum limit for sending overseas payments. And you cansend up to $5 million AUD per transfer. Also, do checkout a short video on how Wise Business' multi-currency account enables cross-border transactions at scale:

Sign up for the Wise Business account! 🚀

In today's globalized economy, businesses face numerous challenges when it comes to managing cross-border transactions. From hidden fees and complex currency conversions to administrative burdens and slow transfer speeds, these obstacles can hinder growth and efficiency.

While registering for Wise Business is free, you’ll need to pay a one-off 65 AUD fee to get local account details in 8+ currencies. After that, there are no monthly maintenance charges.

Other fees include:

If you’re managing a global chain of complex finances daily, Wise Business gives you all the tools to save on fees, simplify your operations, and stay in control — no matter where your money’s going or coming from.

A Wise Business account allows users to can send, receive, and hold in multiple currencies. Experience hassle-free global transactions by transacting like a local business. Here's what you get with a Wise Business account:

Sign up for the Wise Business account! 🚀

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you.

How do you close or deactivate a Remitly account?

To close your Remitly account, email Remitly’s customer support and request an account closure. You will then be provided with specific steps to complete the process.

Does Remitly send money directly to a bank account?

Remitly says you “may” be able to send money directly to a bank account. It depends on where the recipient is located. To make a payment, select the currency, total amount, and delivery speed, and then enter the recipient’s name and bank details before clicking ‘confirm transfer’.

Can I send money to an NRE account using Remitly?

Yes, you can send money to an NRE account if it accepts foreign inward remittance. It’s best to contact Remitly to confirm eligibility for specific countries and currencies.

What are features in a Remitly personal account

Remitly’s feature set is quite stripped back compared to other providers. It focuses on what it does best: helping people send money to people overseas.

Are there any fees with the Remitly personal account

It’s free to create an account. Remitly then states that it always offers “great” exchange rates with no markups. The exact costs depend on the recipient’s country. For example, sending money from Australia (AUD) to the United States (USD) includes a $1.49 standard fee³.

How long does a Remitly transfer take to a bank account

Remitly says delivery speed “varies by location”⁴. It notes that digital transfers via mobile wallets are usually the fastest due to lower processing times, with bank transfers and mail service taking longer.

Sources:

Sources and data furnished in the article is based on publicly available information as of 26th August 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn how the OFX business account works, its features, and how it compares to other international payments solutions. Find out more here!

Discover the best small business bank accounts in Australia for 2025. Compare fees, features, and benefits to find the perfect solution for your business.

Learn what a Stripe account is used for and how to set up a business account in Australia. Explore step-by-step instructions, and international payment advice.

Discover everything you need to know about opening a free business bank account in Australia, from no-fee benefits to comparing free banking options.

Find out how to choose a Business Savings Account and what are some of the best options available in Australia. Read here to find out more!

Want to set up a sole trader business bank account? Learn how separating finances can help your business and explore the best bank accounts in Australia.