Retirement visa Thailand: What should you know?

Read our essential guide to getting a retirement visa for Thailand from Singapore, including requirements, fees and how to apply.

If you want to leave the hustle and bustle of Singapore behind and spend your retirement on the beach or in the mountains, retiring in Thailand may be a good option for you. Just a short flight from Singapore, it offers a balance of affordability and quality of life that is hard to beat.

This guide explores how much you need to retire in Thailand, how to retire in Thailand, where to retire in Thailand, and Thailand retirement visa options so you can make your move with confidence.

We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Retiring in Thailand has become a popular option, especially for Singaporeans who want to take advantage of the lower cost of living. Thailand also offers high-quality healthcare at affordable prices, a warm tropical climate, and a rich cultural heritage with beautiful temples, bustling markets, and pristine beaches.

Take a look at the pros and cons of retiring in Thailand to determine whether it’s the right location for you.

| Pros | Cons |

|---|---|

|

|

If you want to know how to retire in Thailand, you can start by considering the Thailand retirement visa options available to you.

This Thailand retirement visa allows foreigners to stay for one year at a time, with the option to renew annually. It is best for retirees planning to live in Thailand long-term with moderate financial means.

| Category | Details |

|---|---|

| Eligibility criteria |

|

| Financial requirements |

|

| Benefits |

|

| Visa fee |

|

This visa allows wealthy individuals to pay for long-term residency. It is best for wealthy retirees seeking hassle-free long-term residency with luxury perks.

| Category | Details |

|---|---|

| Eligibility criteria |

|

| Financial requirements |

|

| Benefits |

|

| Visa fee |

|

This Thailand retirement visa encourages well-off foreigners to contribute to the local economy in exchange for residency. It is best for retirees with high pension income or investments who are seeking an extended stay.

| Category | Details |

|---|---|

| Eligibility criteria |

|

| Financial requirements |

|

| Benefits |

|

| Visa fee |

|

The cost of living in Thailand can vary depending on where you choose to settle, with places like Bangkok, Chiang Mai, and Phuket being popular choices for retirees. Since Bangkok is the capital, it has the highest cost of living in Thailand, but it’s still cheaper than retiring anywhere in Singapore. For example:

Here’s a bit more detail on the average monthly prices you may expect:

| Thailand | Singapore | |

|---|---|---|

| Rent (1 bed apartment in city centre) | 15,896 THB (627 SGD) | 100,626 THB (3,971 SGD) |

| Basic utilities | 2,639 THB (104 SGD) | 5,116 THB (201 SGD) |

| Transport - local ticket, one way | 25 THB (0.99 SGD) | 50 THB (2 SGD) |

| Meal in an inexpensive restaurant | 100 THB (3.95 SGD) | 304 THB (12 SGD) |

| Cinema ticket | 240 THB (9.47 SGD) | 380 THB (15 SGD) |

Housing will always be one of your biggest monthly expenses, no matter where you retire, but housing prices in Thailand are much lower than in Singapore.

Here’s a look at rental costs in different Thai cities:

| Bangkok | Phuket | Chiang Mai | |

|---|---|---|---|

| 1 bedroom apartment in city centre | 21,687 THB (855 SGD) | 20,807 THB (821 SGD) | 14,845 THB (585 SGD) |

| 1 bedroom apartment outside of city centre | 10,379 THB (409 SGD) | 15,777 THB (622 SGD) | 7,825 THB (308 SGD) |

| 3 bedroom apartment in city centre | 62,061 THB (2,449 SGD) | 65,000 THB (2,565 SGD) | 28,944 THB (1,142 SGD) |

| 3 bedroom apartment outside of city centre | 25,409 THB (1,002 SGD) | 45,500 THB (1,795 SGD) | 16,166 THB (638 SGD) |

If you want to purchase an apartment in Thailand, here are the prices you’ll be looking at:

| Bangkok | Phuket | Chiang Mai | |

|---|---|---|---|

| City Centre Price (per m²) | 191,857 THB (about 7,572 SGD) | 137,500 THB (about 5,426 SGD) | 71,250 THB (about 2,812 SGD) |

| Outside Centre Price (per m²) | 90,424 THB (about 3,568 SGD) | 95,000 THB (about 3,749 SGD) | 50,250 THB (about 1,983 SGD) |

Healthcare is another important expense to budget for when you’re considering how much to retire in Thailand. Thankfully, you won’t have to lower your healthcare standards as Thailand is well-regarded for its medical services, especially in major cities like Bangkok, Chiang Mai, and Phuket, where you’ll find many internationally accredited hospitals.

Though the quality of care is comparable to what you would receive in Singapore, the costs are significantly lower.

Here is a comparison of GP consultation fees in Thailand and Singapore.

| Hospital type | Thailand | Singapore |

|---|---|---|

| Public hospital | 30-200 THB (1-8 SGD) | 900-2,127 THB (36-84 SGD) |

| Private hospital | 500-1,500 THB (20-60 SGD) | 1,000-3,900 THB (39-154 SGD) |

While out-of-pocket costs may seem affordable, it’s still important to have comprehensive health insurance, especially if you’d prefer to go to a private hospital for faster service and English-speaking staff.

Policies vary in price depending on your age, coverage and pre-existing conditions, but you can expect to pay anywhere from 70,000–150,000 THB (2,500–6,000 SGD) per year.¹¹

One of the biggest financial advantages for Singaporeans retiring in Thailand is the favourable SGD to THB exchange rate, which allows you to stretch your retirement savings further. However, when it comes to managing your SGD to THB conversions, relying on traditional banks for international transfers can be costly, as they often offer poor exchange rates and add hidden fees.

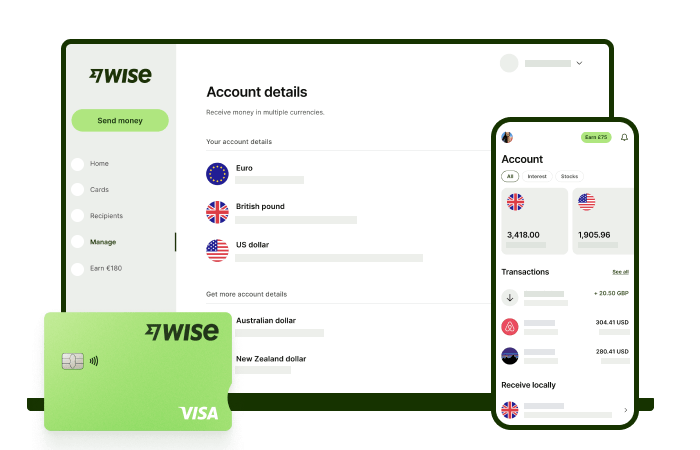

A better alternative is to use Wise, which provides the real, mid-market exchange rate along with low, transparent fees. You can keep 40+ currencies in your Wise account, including THB and SGD, and convert money between any of them, making it easier to manage your day-to-day expenses in Thailand.

Where to retire in Thailand depends on your personal preferences, as each city offers its own unique lifestyle, climate, and cost of living. Here’s a quick look at four popular cities in Thailand for retirees to help you make your decision.

Chiang Mai is a popular choice for retirees who want to be immersed in culture while enjoying a relaxed, slower pace of life. It is known for its welcoming expat community and beautiful, mountainous landscape.

Best for: Retirees seeking a relaxed, culturally rich lifestyle with lower costs and a welcoming expat community. Ideal for those who prefer a slower pace of life away from bustling tourist hubs.

Pros

Cons

For retirees who thrive on city living, Bangkok offers a vibrant, modern environment with a bustling urban lifestyle. It provides access to world-class amenities and excellent connectivity.

Best for: Retirees who want city living, convenience, and access to healthcare, shopping, and social activities.

Pros

Cons

Phuket is the ultimate choice for those dreaming of a coastal retirement. Phuket is the ultimate choice for those dreaming of a coastal retirement with sun, sea, and sand.

Best for: Retirees who want a coastal lifestyle with recreational opportunities and don’t mind a higher cost of living.

Pros

Cons

This seaside town offers a unique blend of peace and accessibility, making it a great option for retirees who want a quiet beach lifestyle without being too far from the big city. Hua Hin has a good mix of locals and expats and is less expensive than popular destinations like Bangkok and Phuket.

Best for: Retirees who want a mix of tranquillity and city convenience without being in a major city.

Pros

Cons

The Wise account is an easy way to hold and exchange 40+ currencies, including SGD, MYR, EUR, CNY, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.26% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 350 SGD when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in SGD and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

✍️ Sign up for a free account now

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Read our essential guide to getting a retirement visa for Thailand from Singapore, including requirements, fees and how to apply.