Top 5 Online Payment Methods for Businesses in Singapore

Discover the top online payment methods in Singapore. Learn how they work and which are best for your business.

Both proforma invoices and commercial invoices are commonly used in global trade, most notably in facilitating international import and export transactions.

In a nutshell, a proforma invoice is a document sent to buyers in the negotiation phase. It helps buyers to plan for and review the cost details of the order before they make a purchasing decision. A commercial invoice is sent after the sale or delivery to ask for payment. It also serves as an important supporting document during the import and export process to facilitate the application of permits and the clearance of goods with customs agencies.

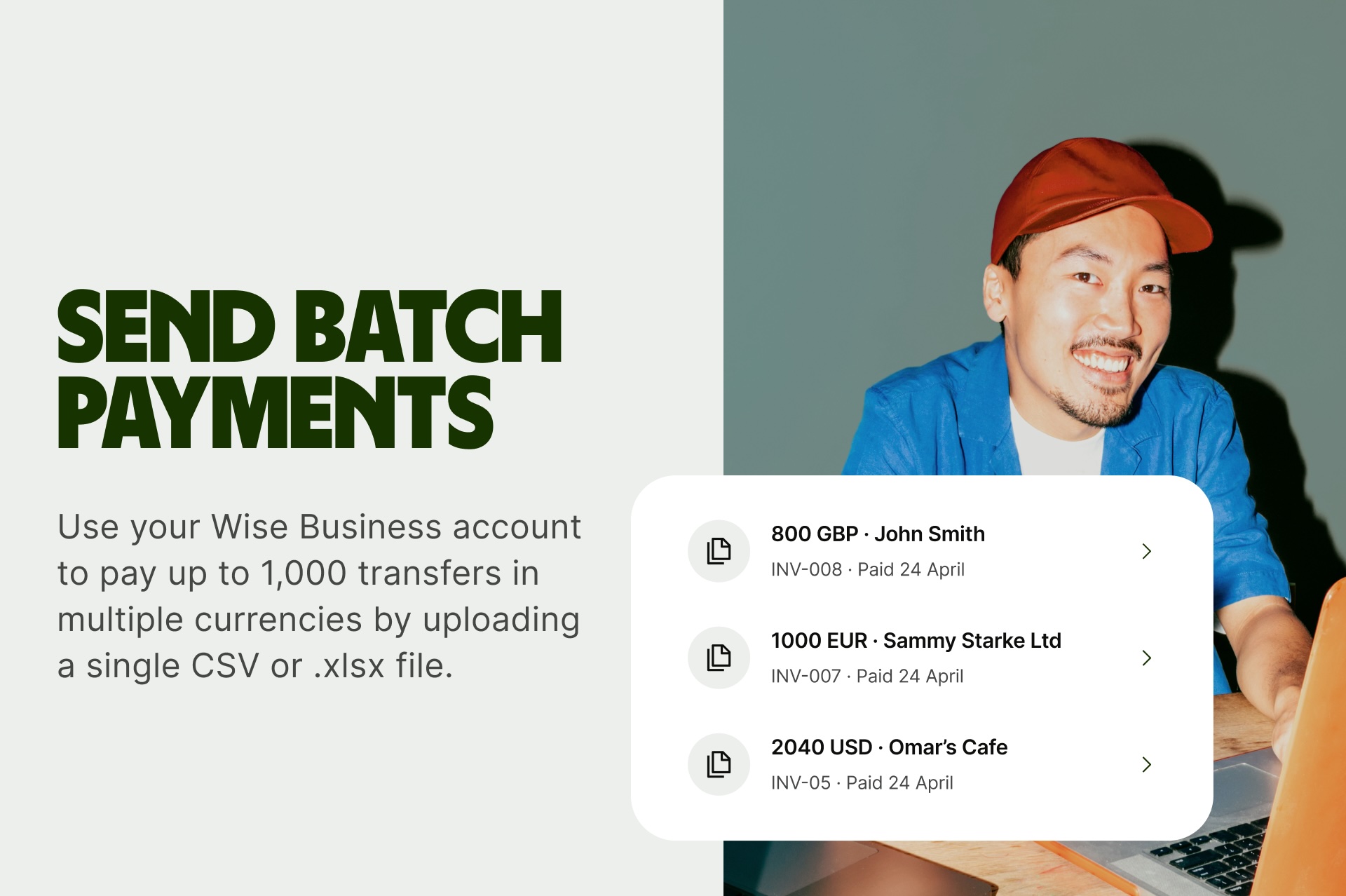

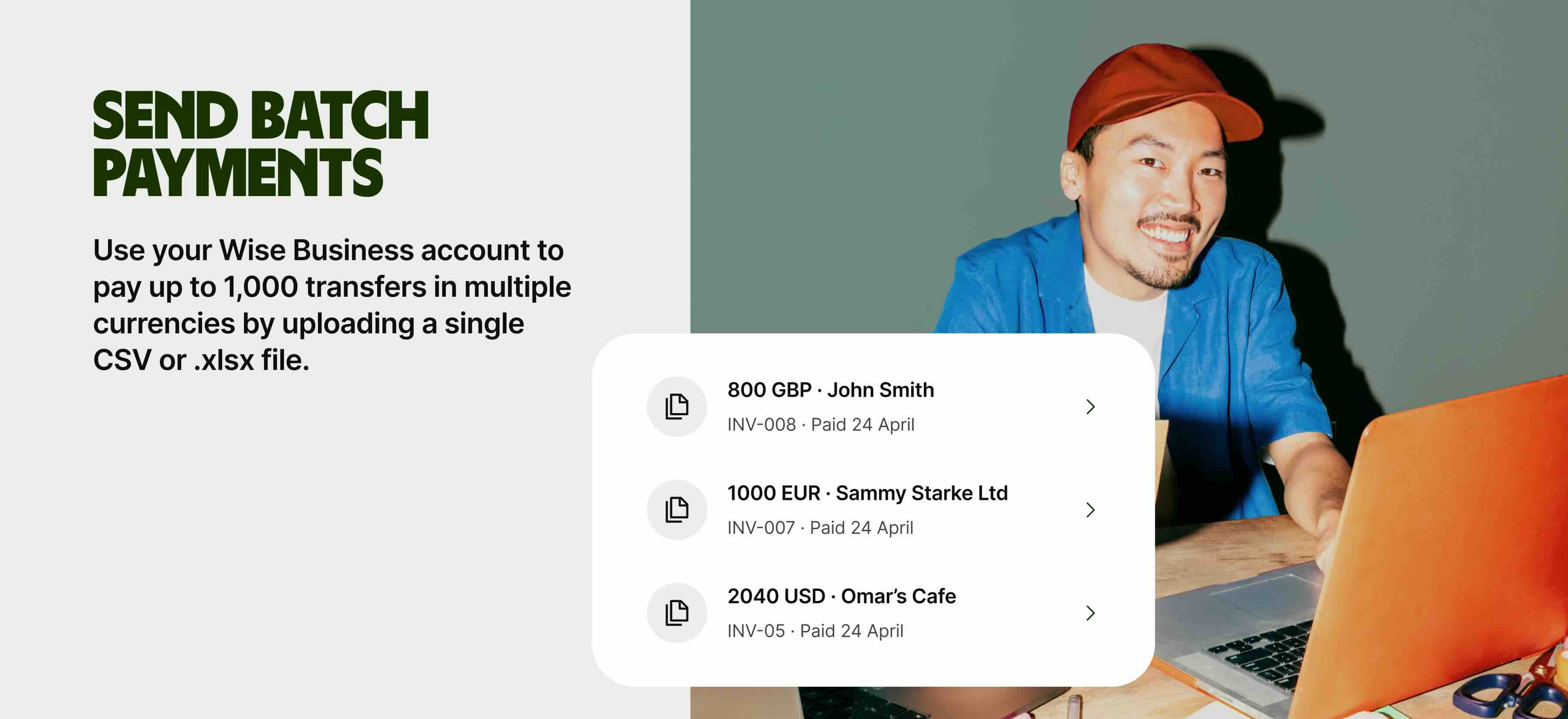

We’ll also mention how Wise Business syncs with popular invoicing and accounting tools, and lets you manage multiple invoice payments efficiently using Batch Payments, leading to massive time-savings and more productive finance operations in your business.

| Table of contents |

|---|

A proforma invoice is a preliminary document with details of a potential purchase. It is typically sent to buyers before goods are delivered¹. Despite its name, a proforma invoice works like a quotation instead.

It provides a price estimate for your client, aiding in their budget management and financial forecasting. It also helps buyers to request financing, such as letters of credit, and to get quotes from freight forwarders. It does not serve as an actual invoice for payment request and is not legally binding.

You should also note that in Singapore, the proforma invoice cannot be used for import permit applications², nor to declare the value of goods for your import permit, nor for the declaration of GST³. A commercial invoice with details of declared value will be required instead.

A proforma invoice should be clearly labelled and include the following information:

You should also note that although proforma invoices are usually used in global trade to facilitate international shipping of goods, certain buyers may also require them for the sale of goods within Singapore.

A proforma invoice should be issued when an order is received or when a quotation is requested by a client. It provides the buyer with details of the costs, helping to facilitate the planning of the purchase.

For example, Singa’s Semicon receives an order for 30,000 custom semiconductors from a client based in Taiwan.

Singa’s Semicon will issue a proforma invoice to their client with details of the semiconductors to be delivered, including the price of the semiconductors, along with an estimate of all other costs and charges that may be incurred in the delivery process.

Their client would review the proforma invoice and issue a purchase order (PO) to signal acceptance of the order if they are satisfied with the details. If not, they can choose to renegotiate or turn down the purchase.

A commercial invoice is a bill for goods sold, issued by a seller or exporter for global trade. It is generally required for customs clearance, can be used as a formal record of the transaction and is legally binding.

A commercial invoice should be clearly labelled and include the following information:

Singapore businesses should note that when clearing goods through Singapore Customs, you may be asked to provide a commercial invoice, packing list and Bill of Lading/Air Waybill³.

The commercial invoice is issued after the sale has been finalised.

Although it may be issued after the items have been delivered or shipped, you would likely need to produce a copy of the commercial invoice when attempting to export your goods from Singapore.

Let’s go back to the example of Singa’s Semicon’s semiconductors sale.

Upon receiving the PO, Singa’s Semicon would proceed to prepare their semiconductors for shipping and issue a commercial invoice to their client in Taiwan.

Singa’s Semicon will need to submit a copy of the commercial invoice when applying for an export permit via TradeNet⁴. They may also be requested to provide the commercial invoice along with a packing list and Bill of Lading (B/L) or Air WayBill (AWB) in order to clear their goods for export through Singapore’s customs⁵. Singa’s Semicon would have to ensure that they have the commercial invoice and other supporting documents on hand when they are ready to ship their semiconductors out.

Singa’s client may also require both proforma and commercial invoice in order to facilitate the import of goods to Taiwan.

| 💡Did you know you can create invoices with the free invoicing tool that comes with a Wise Business account? Learn more here. |

|---|

Both proforma invoice and commercial invoice are used in global trade and may still appear very similar to you. Here are two key differences you should note when issuing these invoices.

In summary, a proforma invoice is a preliminary document issued to a client before a sale with details of the potential sale, while a commercial invoice is the final bill issued after a sale and is typically used for payment and customs clearance.

You should issue a proforma invoice when your client asks for a quotation on your products, and issue a commercial invoice after the sale is confirmed. Your company should also have the commercial invoice on hand to facilitate the export and import process of your goods at customs.

| 💡Having trouble managing multiple invoice payments efficiently? Wise Business can streamline your payment process, save you hundreds of manpower hours, and do it all with no hidden exchange rate markups. |

|---|

➡️Explore Wise Business Batch Payments today

Sources:

Sources checked on 28 May 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Discover the top online payment methods in Singapore. Learn how they work and which are best for your business.

Discover how Singapore businesses can use link payment to handle transactions with customers, and how easy it is to set up payment links with Wise Business.

Tired of slow payments? Learn how to set up a PayNow QR code, get paid instantly in SGD, and keep your cash flow happy — no chasing, no fuss.

Explore the best invoicing software for small businesses in Singapore—compare tools, pricing, and features to help you scale and get paid faster.

Discover if Tazapay is right for your Singapore business with our in-depth review of its features, pricing, and benefits.

What is the purpose of a credit note, and what must businesses note when issuing one? Learn the essentials of using credit notes in Singapore.