GST Exemption List Singapore: Complete Business Guide for 2025

Complete guide to Singapore's GST exemption list. Learn which supplies are exempt, out-of-scope, or zero-rated and how it affects business compliance.

If you’ve been thinking about how to start a business in Singapore, this guide is here to help.

Setting up a company involves a lot more than a good business idea. You will have to get acquainted with business registration processes, how to hire employees, the law around filing and paying business taxes and more.

In this article, we will cover:

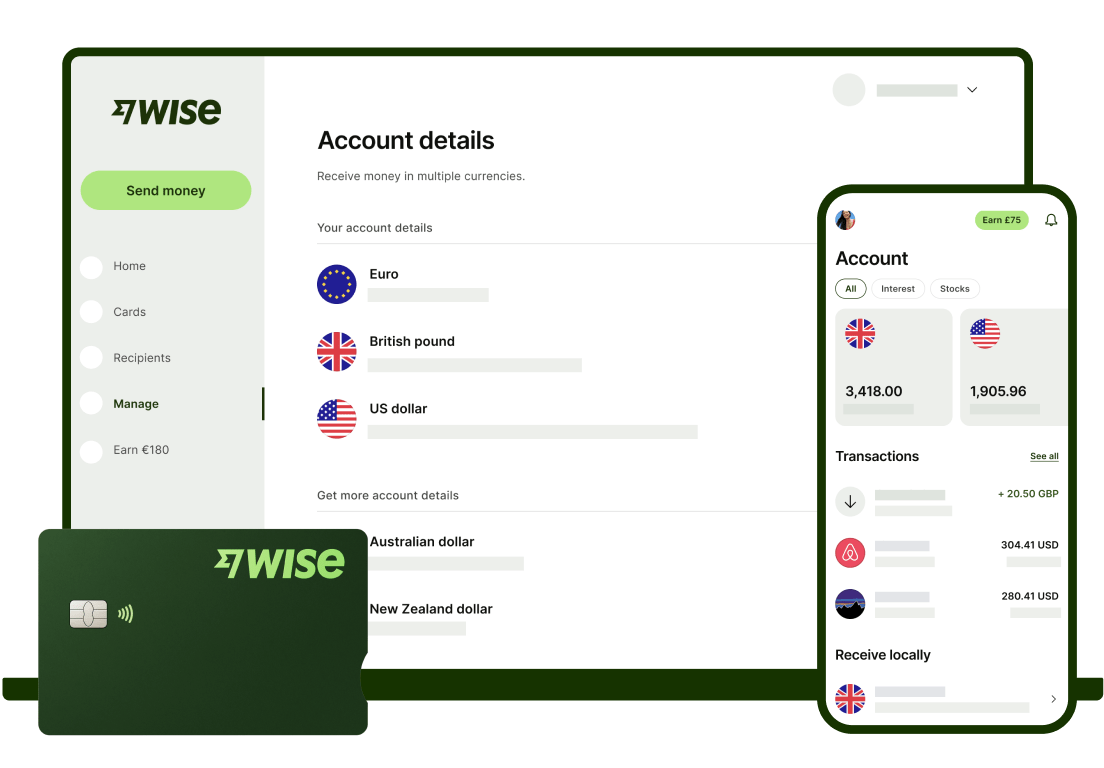

| Need to open a business account for your new company quickly? With a Wise Business Account, you can get set up and receive payments from different countries in minutes, all from your laptop or phone. |

|---|

| Learn more about Wise Business |

Let’s start at the beginning. Opening a business in Singapore is a huge adventure - but it’s also a challenge.

Before you get started, make sure you’ve got a solid plan for your company and how you’ll make it a success.

Investing time in research and planning at this stage is crucial to make sure you can hit the ground running, so before you start to fund and register your new Singapore company, you’ll want to have:

If you’re feeling confident about all of these, it’s time to move on.

Before you can launch your business you’ll need to work out how you can fund and finance it.

Your business plan and initial financial forecasts should give some indication as to what funding you’re likely to need, and when.

However, you’ll still need to work out where the money will come from to get your company up and running.

You may choose to:

While you’re making your decision, it’s worth splitting out your costs into capital costs - one off payments - and fixed ongoing costs.

Capital costs are likely to be things involved in setting up your business. While these will vary widely depending on the type of business they may be things like the costs of setting up a website, or buying equipment.

Fixed costs on the other hand tend to be ongoing, like rent for a business premises or salary for your employees. Having a plan for these costs is essential to protect your cashflow as you’ll need to pay them even if your business isn’t yet turning a profit.

Did you know you can reduce ongoing costs such as international transaction fees and unfavourable foreign exchange rates with Wise Business? Wise is a cost-effective and easy way to run your business in multiple currencies or enter new markets.

Starting a business in Singapore includes some mandatory steps, like registering your company and reserving a name.

However, these are actually pretty low-cost, which means it’s feasible in theory to start a business in Singapore with more or less no capital.

We’ll look at the costs of registering a business in Singapore later - but it’s good to know that this could be as low as 115 SGD.

Mandatory costs are unavoidable - however, if you’re hoping to start a business for the lowest possible cost you’ll need to consider a few things like:

How you report and pay your business taxes will depend on your business entity type, and the turnover of your company, among other things.

Tax reporting processes - and tax rates - are different for corporations and other larger business entities³.

As with anything to do with taxes, it’s relatively complex, even though IRAS does make it as easy as possible to report and pay your taxes online. Getting professional advice would be a smart plan, to make sure you’re fulfilling all your obligations.

There’s also a helpful start up kit which can support many new entrepreneurs in navigating tax matters⁴ - check out the IRAS website for more.

Your next step will be to reserve your business name with ACRA - the Accounting and Corporate Regulatory Authority⁵. First you’ll need to check the name you’ve selected is not already in use, which you can do through BizFile⁶.

As part of your ACRA registration you’ll also need to add a business and residential address⁷.

If you intend to work from home you may need approval, depending on the property type - for example, if you’re living in an HDB you’ll need to get the go ahead before you can register your home as a business.

At this stage you’ll also need to add your residential address, or an alternative address where you can be contacted if you don’t want your home address to be on public record.

Let’s take a look at the most commonly used business entity types in Singapore⁸, including their definition and the fees to set up and register this type or business:

| Entity type/Description⁹ | Sole proprietor | Partnership or limited partnership | Limited liability partnership | Company |

|---|---|---|---|---|

| Definition | Owned by 1 person | Owned by 2 or more persons | Partnership where the partner’s personal liability is limited | Separate legal entity from shareholders and directors |

| Ownership | 1 person | 2 to 20 people for a partnership 2 or more for a limited partnership | 2 or more | Varies based on entity type |

| Legal status | Not a separate legal entity from the owners | Not a separate legal entity from the partners | Separate legal entity from the partners | separate legal entity from the owners and directors |

| Set up/registration cost | 115 SGD for one year | 115 SGD for one year | 115 SGD | 315 SGD |

If you’re setting up a sole proprietorship or partnership you can do so yourself in BizFile¹⁰.

For more complex legal entity types, seek professional advice.

➡️Check out our article here on how to pick the right business structure type for your Singapore company.

All of Singapore’s major banks have a good range of business bank accounts, from low fee online only offerings, to accounts with more features which may charge higher fees and suit more established businesses.

In many cases you’ll be able to open your Singapore business bank account online - although whether or not this is possible will depend on your business entity type, residency and relationship with the bank you select.

➡️ Learn more about the best corporate bank accounts in Singapore here.

If you’re looking for a low fee, feature packed multi-currency account in Singapore, check out Wise Business. Open your account fully online for a one-time fee of to get all the features, with no ongoing charges and no minimum balance requirement.

Wise Business provides local SGD bank details for your business, including 8 other bank details (USD, EUR, AUD, etc) for no extra cost - so you can get paid like a local from 30 countries. You’ll also be able to hold and exchange 50+ currencies, using the mid-market exchange rate with transparent fees* to send payments to 70+ countries - just what you need when you’re just starting your business.

Wise also offers business friendly perks like batch payments which let you send up to 1,000 transfers at once, in your preferred currencies, linked debit cards for easy spending, and cloud accounting integrations so you can keep on top of everything easily.

*Please see Terms of Use for your region or visit Wise Fees & Pricing: Only Pay for What You Use for the most up-to-date pricing and fee information.

Once your business is off the ground it may be time to get some extra help.

If you’re planning on hiring employees in Singapore, the first thing to do is to apply for a Central Provident Fund (CPF) submission number. You can do this online through BizFile for convenience.

Make sure you’re clear on the processes and requirements for both employee and employer CPF contributions, and when they apply. In most cases you’ll be responsible for administering all withholding and contributions - but exactly how this works does depend on how much your team member earns, so it’s best to get some professional advice to make sure you’re clear on the rules in your case.

It’s also worth checking if you’re required to buy work injury compensation insurance, based on the type of work and income of your employees.

Finally, bear in mind that different rules apply when you’re hiring foreign workers - get all the advice you need to make sure the process runs smoothly.

➡️Get all you need to know about the CPF contribution rate here.

How you go about filing your business taxes will depend on your business entity type.

If you’re a sole proprietor or in most types of partnerships, your business is not considered a separate legal entity from a tax perspective. That means it’s easy to file your taxes with IRAS online through SingPass¹¹.

Estimated submission time is just 5 - 10 minutes, and you can even do it from your phone. Make sure you’ve taken a look at the IRAS website to check the documents and details needed in advance, so you can get everything done smoothly.

If you have a registered company you’ll need to follow a separate tax filing process - in this case you’ll be best off getting professional advice.

Foreigners can register a business in Singapore. If you’re legally resident here and hold an appropriate pass you may be able to register your company alone.

If you’re not a Singapore resident, you may find you need a local representative, director or manager, depending on the business entity type¹².

The good news is that there are companies like Sleek for example, which can help you set up a business in Singapore as a foreigner, to keep the experience hassle free.

If you're not living in Singapore but need local bank details, you can open a Wise multi-currency account online to get your local SGD bank details without the hassle of applying for a bank account as a foreigner.

| Need a SGD bank account but not residing in Singapore? Open a Wise multi-currency account online to get local SGD bank details from anywhere! |

|---|

Starting a business in Singapore is a big adventure - and as Singapore is well known for ease of doing business, you can rest assured that the process is pretty straightforward too.

Getting your company up and running is a more of a marathon - not a race - so, if at any time you are unsure of some details on how to start a business, check back in to the Wise Singapore Blog where you can be sure there’s support for you at every step of the way.

Use this guide to get started - and good luck!

Sources checked on 19.09.2022

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Complete guide to Singapore's GST exemption list. Learn which supplies are exempt, out-of-scope, or zero-rated and how it affects business compliance.

A full review of the Sleek business account for Singapore companies including its features, fees, and benefits.

Discover what Zero-Rated GST is, how 0% GST can help your Singapore business save on taxes, how to qualify for it and more.

Compare the best startup bank and non-bank solutions in Singapore. Find the right banking solution for your growing business with our complete guide.

Discover the most profitable small business ideas in Singapore for 2025. From e-commerce to consulting, find the perfect market for your new business today.

Learn what Corppass Singapore is, how roles work, and the Singpass/SFA login. Step-by-step setup and key services for IRAS, ACRA, MOM, CPF.