CIMB vs Maribank (formerly SeaBank) comparison: Which is better in the Philippines?

Comparing between SeaBank and CIMB in the Philippines? Find out which bank account is better for Filipinos.

| ⚠️ Update: Effective 8 September 2025, SeaBank is now officially known as MariBank. This article has been updated to reflect this change, though some historical references to "SeaBank" may remain. |

|---|

MariBank¹ offers Filipino citizens and residents convenient ways to save, spend and get a loan. Maya Bank² has a variety of savings accounts, debit and credit cards and extra services like buy now, pay later accounts to spread the costs of a big transaction over several installments. But which is better, Maya or Maribank (formerly SeaBank)?

This guide puts Maribank vs Maya head to head so you can review and compare the features available, and the fees that apply. We’ll cover the Maya vs MariBank interest rate if you’re looking for a savings product, as well as the card options from each if you’re more interested in a transaction account for day to day spending. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

No. Maya and MariBank are not the same company.

Both offer some similar products for Filipino citizens and residents, covering convenient ways to manage your money on an everyday basis, as well as products to save and earn interest. However, the account types, features and fees are not the same - so to decide which is best between Maya vs MariBank you’ll need to invest a bit of time looking over the products available from each.

Maya Bank is the company behind the Maya wallet - formally PayMaya - and the digital banking arm of Voyager Innovations. Maya Bank is a licensed and regulated bank in the Philippines and offers services for individual and business customers across a very broad range of product areas.

This guide explores some key products used by individual customers - plus you can take a look at the business accounts and services if you need a handy way to keep your company finances in order.

MariBank is part of Sea Limited which originated in Singapore and is listed on the New York stock exchange. You may know Sea Limited as the parent company of Shopee - but there are also several other enterprises across digital services which come under the same family of businesses.

MariBank offers a digital savings account, card and loan option for eligible customers, which has low costs and easy ways to manage your money with just your phone or laptop.

As we’ve mentioned, some of the products and features available from Maya vs MariBank are quite different.

Let’s start with a head to head overview, and then move on to look in more detail at some core products including the interest earning savings products offered by each, and the payment cards you can get for day to day spending.

| Feature or service | Maya Bank | Maribank (formerly SeaBank) |

|---|---|---|

| Eligibility | At least 18 years old, Filipino citizen or resident | At least 18 years old, Filipino citizen or resident US persons need an SSN |

| Saving accounts | Available - Savings account³, Personal goals account, Time deposit | Available - Savings account |

| Maximum available interest rate | 14% | 3.5% |

| Debit cards | Available | Available |

| Credit cards | Available to select customers | Not available |

| Cash back on card spending | Not available | Available |

| Local payments | InstaPay andPESOnet | InstaPay andPESOnet |

| International payments | Not available | Not available |

| Credit facilities | Available - loans, credit, buy now, pay later, credit cards | Available - loans for select customers only |

| Business services | Available | Not available |

| Regulated and PDIC insured | Yes | Yes |

*Details correct at time of research - 29th August 2025

Overall, there are more products available from Maya compared to MariBank, with a bigger range of card types and credit facilities, as well as several different ways to save. However, MariBank does have a few advantages that Maya does not. For example, you can earn cash back on your card spending, and you can make some InstaPay transfers every month without needing to pay a fee.

It’s worth noting that both MariBank vs Maya are best for local use only. They do not allow you to send money internationally and if you spend with your card overseas you’ll pay a foreign transaction fee which means your purchases may be more expensive than you expect.

In the end the best choice between Maya vs MariBank will depend on your personal preferences and how you want to transact. There’s no single best account type - but by comparing both of these high quality local providers you may be able to find a smart solution for your needs.

Both Maya and MariBank offer a savings account. In addition to this, Maya also has extra interest bearing products which we’ll look at in more detail in a moment.

For both Maya vs MariBank, this is the core deposit account available for all customers. The accounts have low or no costs to operate and offer a good way to hold, receive and spend PHP locally in the Philippines. Let’s take a look at the features you get, head to head:

| Feature or service | Maya Bank | MariBank |

|---|---|---|

| Opening fee | No fee | No fee⁴ |

| Minimum balance | No minimum balance | No minimum balance |

| Maintenance fee | No fee⁵ | No fee |

| Base interest | 3.5%⁶ | 3.5% |

| Debit card available | Yes | Yes |

| Local transfer fee | InstaPay transfers 15 PHP PESOnet transfers have no fee | 15 transfers/week free, then 15 PHP |

| International transfer fee | Not available | Not available |

*Details correct at time of research - 29th August 2025

The options for Maya vs MariBank on interest rates are quite different. This makes it pretty hard to compare, so you’ll need to read through the details of the different account options to decide which is right for you.

MariBank has only one advertised interest bearing product - the mobile savings account, which has a tiered interest rate based on balance. Maya on the other hand has 3 different interest earning products - the savings account, the Personal Goals product and time deposit accounts. Each has different rates, including variable rates depending on how you transact.

MariBank interest rates are 3.5% up to a balance of 1 million PHP, dropping to 3% for amounts above that level⁷.

Maya Savings accounts earn 3.5% base rate, with the opportunity to raise this interest level as high as 15% by completing specific actions. You’ll get the 3.5% automatically when you open your account, and can then boost your rate by transacting more frequently, opening credit facilities, investing with Maya and completing other account related tasks⁸.

Maya Personal Goals earn 4% interest. There are also Maya time deposit accounts which earn 3.5% to 6% depending on how you use them.

*Details correct at time of research - 29th August 2025

MariBank and Maya both have debit cards which are linked to their savings accounts.

MayaBank also offers credit cards to select customers, which have their own features and fees. In this comparison we’re only looking at the debit card options from Maya vs MariBank.

As you’ll see, both providers have cards issued on globally accepted networks which means you can use them to spend and withdraw at home and abroad. Fees apply if you use your card overseas, and costs may also apply when you get cash from an ATM. Maya has a foreign transaction fee of 2.75%, while the MariBank fee is 2% - this means that spending in a foreign currency costs you more than spending in pesos.

It’s good to know that both providers also offer virtual card options which can add extra security when you spend with an online retailer or make payments through an app.

Here’s a head to head comparison on Maya vs MariBank on debit card options so you can decide if either looks to be a better fit for you.

| Feature or service | Maya Bank Debit Card⁹ | MariBank Debit Card¹⁰ |

|---|---|---|

| Card order fee | No fee when you deposit 250 PHP to your account or meet other criteria | 99 PHP |

| International usage | Available globally anywhere network is accepted | Available globally anywhere network is accepted |

| ATM fee | Usually 10 PHP - 18 PHP¹¹ | 15 PHP |

| International ATM fee | Fee set by ATM operator | No fee |

| Foreign transaction fee | 2.75%¹² | 2% |

| Virtual card available | Yes | Yes |

| Cashback options | Not specified | Yes |

*Details correct at time of research - 29th August 2025

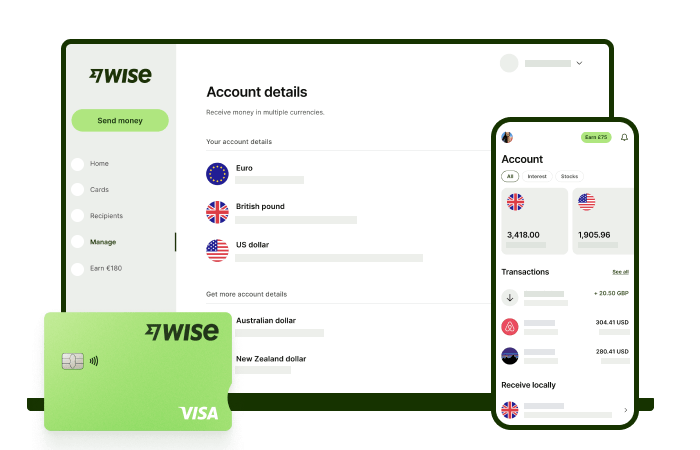

Make seamless foreign currency payments and transactions with low fees and the mid-market rate with Wise.

Ang Wise account ay isang madaling paraan mag-hold at mag-exchange ng 40+ currencies, kasama na ang PHP, USD, CNY at marami pa. Kailangan mo lang gumawa ng libreng account para makapagsimula.

Sa Wise, pwede kang mag-exchange ng pera sa mid-market rate, yung totoong exchange rate na nakikita mo online, na walang patong! Plus, pwede ka rin mag order ng Wise card para mas convenient gumastos na walang foreign transaction fees. At kung kailangan mo ng cash, pwede ka ring mag-withdraw ng up to 2 beses nang libre (up to 12,000 PHP) kapag nasa abroad ka. Makakakuha ka pa ng 8+ local account details para direkta kang mabayaran sa Wise account mo sa peso at sa iba pang major global currencies.

Magse-send ka ba ng money or magbabayad abroad? Nag-o-offer din ang Wise ng fast at low-cost transfers na abot 140+ countries - pwede mong i-track ang transfer mo sa account mo at ma no-notify din ang recipient mo kapag dumating na yung transfer.

Get the most out of every peso and save more when you use Wise.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Comparing between SeaBank and CIMB in the Philippines? Find out which bank account is better for Filipinos.

Working abroad or getting paid in foreign currency? Learn about the BDO Kabayan Savings account requirements and options to receive and remit money.

Find out which are the best digital banks in the Philippines and how they compare.

Looking for the best US Dollar account in the Philippines? This guide compares top providers and their features to help you find the perfect fit.

This guide provides all the details on receiving Ria Money Transfers in the Philippines, including requirements, and different receiving methods.

Learn about PNB Dollar Accounts in the Philippines. This guide covers account opening requirements, and everything you need to know.