How to become a virtual assistant in the Philippines: Get started as a beginner

Learn more about how to be a virtual assistant in the Philippines and what kinds of jobs are suitable for beginners.

The year is 2025, and freelance, remote work is all the rage these days. Becoming a freelancer in the Philippines offers exciting opportunities for Filipino professionals seeking better income and flexibility.

While freelancing sounds like a dream come true, getting started and actually finding clients can be tricky. In this blog post, we’ll walk you through the gig economy and how to be a freelancer in the Philippines. We’ll also show you how you can better manage your finances with Wise so you can stretch every hard-earned peso.

| Table of contents |

|---|

Freelancing is a type of self-employment where you offer services to your clients on a project or contract basis, rather than the traditional 9-to-5 job where you have to remain at work with a single employer in order to be paid.

In the Philippines, freelancing has gained a massive amount of traction in the past years, partly due to the restrictions of in-person work that COVID brought us, but also due to better internet connectivity, a growing global demand, and the increasing appeal of flexible, work-from-home jobs.

With an educated, English-speaking population and the typically efficient, reliable Filipino mentality, many Filipinos are now successfully employed by international clients.1

The primary reason why freelancers choose this path is because of flexibility, as for many, work-life balance is a top priority. Unlike traditional employment, where you get paid a fixed salary for a certain number of hours, freelancers can control their time, clients, rates, and the amount that they work, earning accordingly.

You can work for multiple clients at the same time, and successful freelancers even get to pick and choose their clients. However, freelancers are also responsible for securing their own projects and managing finances. Also, a freelancer's salary can fluctuate wildly, swinging from a certain amount one month to a fraction of that another, which can be unnerving if you are used to a fixed salary.

Many Filipinos wonder how to start freelancing with no experience. You aren’t alone. Here’s a step-by-step guide to help you out.

First, you’ll have to identify what you want to do and what skills you have to sell to clients abroad. Many Filipinos are now employed in fields such as website design, programming, content creation, and digital marketing. Virtual assistants are also in great demand as the growing number of remote workers increases.

Capitalize on your existing skills, or seek or learn new ones. If you’ve got a knack for technology, you can think about picking up programming, video editing, or web design. Those with a talent for words can consider writing blogs, scripts, or marketing materials. Lastly, those with stellar organizational skills can help out busy professionals with some secretarial duties.

For many freelancers, the first step is often the hardest. Without experience or a portfolio, landing your first client might be tricky. Even without experience, you can start to build a portfolio to show potential clients sample projects based on real-world situations.

For example, if you are aiming to be a content writer, you can write blog posts, website copy, or product descriptions in the niche that you want to write for. If you want to do graphic design, you can create mockup pages, logos, or marketing materials for fictional brands.

You might even want to consider doing your first job or two as pro bono work or at a discounted rate, with the condition that you are allowed to use what you’ve created as part of your portfolio. A good way to start is to check with your circle of friends or non-profit organizations, offering your services where applicable.

Once you’ve got a basic portfolio going, you can start submitting applications on freelance platforms or reach out to potential clients directly, pitching your work to them.

A huge part of being a freelancer is knowing where to look for online freelance jobs. Remember, you can take on multiple clients at once, and it all depends on how much you want to earn, but ideally, you’ll have a solid base of clients that give you steady work throughout the month so your income doesn’t fluctuate too wildly. Here are some of the most popular freelance platforms with Filipinos.

This is a massive online marketplace where clients can post jobs for free and freelancers can apply for them using ‘Connects’, which are typically purchased. The more valuable the job, the more Connects you’ll have to spend. UpWork then takes a variable fee, ranging from 0% to 15%2, on your earnings, but certain contracts like Upwork Payroll, Any Hire, Direct Contracts, and Enterprise may be exempt or charged differently.

You can find both project-based and hourly-rate-based jobs on UpWork, but competition is fierce, and the platform can be filled with unscrupulous clients who post jobs for free, receive the work, and do not pay. That’s when UpWork’s payment protection comes in. Clients have to deposit the amount in escrow, which UpWork will hold onto before releasing the payment to you when the work is done.

Fiverr is similar to UpWork, where freelancers post their services, rates, and portfolio online, and your potential clients browse for what they want. Fiverr takes a 20% commission from the fees you earn3.

Fiverr is especially popular for creative and digital services like graphic design, video editing, or content creation. The platform is great for beginners, but you would need a good introduction, have a basic portfolio, and accumulate excellent feedback to succeed.

This is the go-to site for remote workers in the Philippines, specifically designed for Filipino talent to find foreign employers. Clients looking to hire have to pay a monthly fee, varying from USD$69 to $994, depending on how many jobs they want to post a month. There is also no free account, so if you have a client who gets in touch with you regarding your services, they’ve paid for the right to contact you.

Jobseeker accounts are free, so all you have to do is register, fill in your profile, and start applying for jobs.

In addition to these main ones, there are numerous job search sites out there where you can simply search for the term ‘freelance’, and further filter it down to your specific field. Try Flexjobs, WeWorkRemotely, Coursera, RemoteJobsFinder, and RemoteJobs.io for a start.

Setting your freelancer rate can be tricky. There are two primary ways to bill: project-based or hourly. In the global freelancing market, Filipinos offer an advantage through their competitive pricing, high-quality deliverables, and a strong work ethic.

Clients often find great value in the skills of Filipinos, whether in graphic design, content creation, or virtual assistance. Understanding your niche is crucial to establishing your rate and positioning yourself competitively.

For example, writers from the Philippines earn about PHP 300 per page for copy and PHP 2.97 per word for content.⁵ Virtual assistants make about PHP 28,915 a month.⁶ In addition, skilled jobs like web programming, data analytics, and financial services tend to pay significantly higher than generic jobs such as virtual assistants.

Either way, remember that freelance income is subject to tax in the Philippines, so be sure to comply with your tax laws to avoid hefty fines.

👀 For a comprehensive guide on Philippine tax laws for freelancers, read this article.

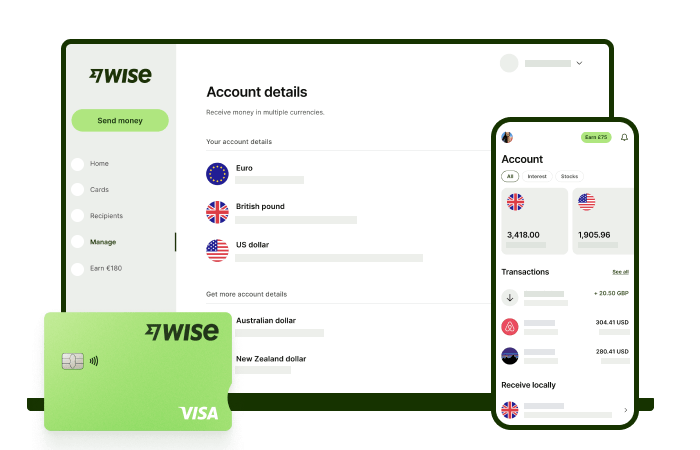

Alam mo ba na mahigit 76% ng mga Pinoy ang nagsasabing mahalaga sa kanila ang low at transparent fees kapang tumatanggap ng pera galing abroad? Sa Wise, yan 'mismo ang makukuha mo! Mag sign-up ka lang ng libreng Wise account, at puwede mo nang i-manage ang pera mo gamit lang ang phone mo.

Magkakaroon ka ng access sa 8+ local account details para sa major currencies, tulad ng PHP, USD, GBP, AUD, at marami pang iba. Kaya, mas madali at convenient na makatanggap ka ng pera direkta. Kapag natanggap mo na ang pera mo, madali mo itong mai-convert sa 40+ na currencies, with low fees, at sa mid-market rate - ito yung totoo at nakikita mong rate sa Google. Kasama na dito ang pag-exchange ng PHP, na may kasamang one-time conversion fee na nagsisimula so 0.57%. Kitang-kita na agad 'yan upfront, walang patong o hidden fees.

Kaya, tumanggap, mag-exchange at ilipat ang iyong sahod sa iyong local bank account sa PHP gamit ang Wise para sulit ang bawat piso.

*Disclaimer: Ang porsyentong nabanggit sa itaas ay batay sa isang internal survey na isinagawa ng Wise noong Abril 2024.

Sources last checked: 22 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to be a virtual assistant in the Philippines and what kinds of jobs are suitable for beginners.

Want to get started with an online freelance job as a beginner? Learn more about what the best jobs are and which is the most suitable.

Want to freelance and need to register with the Department of Trade and Industry? Find out if you need to do it, and how to register.

Want to freelance and need your PTR? Find out more about how to get it, what you need it for, and more.

Find out more about Philhealth contributions and how much you should pay for freelance and self-employed Filipinos.

Find out more about SSS contributions and how much you should pay for freelance and self-employed Filipinos.