How to cash in Maya: Guide on topping up your Maya wallet in 7/11, with GCash and more

Wondering how to top up your Maya wallet? Learn more about how to add money at 7/11, using GCash, using credit card, and more.

PayPal¹ is a globally popular provider which offers accounts to send, receive and spend in many currencies and countries. In the Philippines you can open a PayPal account to send money to others at home and abroad, receive incoming transfers, and shop online with local and international retailers.

If you’re new to the service and wondering how to cash in PayPal, this guide is for you. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

The good news is that you don’t need to cash into PayPal to add a balance if you don’t want to². Instead, you can link a bank account to PayPal, or link your credit or debit card. When you send a payment or buy something online, the money is taken directly from the linked bank or card you select, with no need to top up PayPal first.

It’s sometimes possible to add money to a PayPal balance³ yourself if you’re happier knowing there’s some money there when you need it - plus you can also use PayPal to receive payments from others⁴. Once you have a balance you can then hold, withdraw or spend your money.

We’ll look in more detail a little later at how to cash in PayPal using GCash, and also how to cash in PayPal using credit card and a linked bank.

There’s no fee to receive a payment from someone else into your PayPal Philippines account⁵, and there’s no PayPal fee to top up your account by cashing in from a linked bank or card. Bear in mind that the person sending you money will need to pay fees in most cases, which can be pretty steep if they’re cashing in your PayPal from abroad. If you’re adding money from your bank, your bank may also charge you a fee for the service.

You will find fees of 3% apply if someone sends you a payment in a foreign currency. For example, if you’re sent a payment in EUR, and want to convert it to PHP to spend here, you’ll pay a PayPal currency conversion fee of 3%.

Before you can use PayPal you’ll need to register an account and get verified by linking a local bank or card.

Not all PayPal accounts can be topped up. To see if you have the facility to hold a balance in your PayPal account you’ll need to log in and then go to the Transfer Money option and look for the option to add money from a bank. If you can’t top up this way you could still have someone else send you a payment, or just link your bank or card to spend without topping up first.

If someone sends you a payment and you don’t have a PayPal account yet you’ll get an email and will be invited to sign up for an account to receive your money. Watch out for scams here - check the email you receive is real before you take any action.

If your PayPal account supports holding a balance there are several ways to cash in PayPal in the Philippines. You’ll usually find you first need to link the account or card you want to pay with, to PayPal. Once you’ve done this you can then top up your balance, where available, by taking the following steps:

- Open the PayPal desktop site and go to your Wallet

- Click Transfer Money

- Click Add money to your balance

- Follow the instructions to add money according to the payment method you select

Let’s look at some common and popular options.

In some countries, such as the US, you can cash in PayPal at store locations by handing over cash for deposit to your account. PayPal does not advertise this service in the Philippines so you may not find any local stores which can help you. 7- eleven do offer some solutions to top up Maya wallets - and have plenty of other ways to pay bills and load accounts - but PayPal isn’t listed as an option⁶.

If you’re lucky enough to find a 7/11 location which lets you add money to PayPal, you’ll be guided through the process by the store staff. To give a flavour, this is how you cash in PayPal in 7/11 in the US⁷:

v1. Log into the PayPal app and tap PayPal balance

- Tap Add Cash at Stores and select a 7-eleven as the retailer

- At your local store, tap to generate a barcode on your phone

- Show the barcode to the cashier and hand over the money you want to add

- The cashier will scan your barcode and add the money

You can also choose to link your PayPal account to your GCash account. This may allow you to move money between the 2 providers more easily. Here’s how to link PayPal and GCash so you can make transfers⁸:

- Log into the GCash app and tap Cash In

- Tap Global Banks and Partners, then PayPal

- Enter your PayPal login credentials and tap Next

- Tap Okay on the confirmation page

Once your account is linked you’ll see the option to cash in PayPal from GCash if it’s available from your account type.

You may be able to cash in PayPal using a credit or debit card if your account can hold a balance. To do this you’ll need to link your preferred credit card to PayPal, taking the following steps⁹:

- Log into the PayPal app and go to Wallet

- Tap Link a debit or credit card

- Follow the instructions to add your card details

- Verify the card, following the onscreen prompts

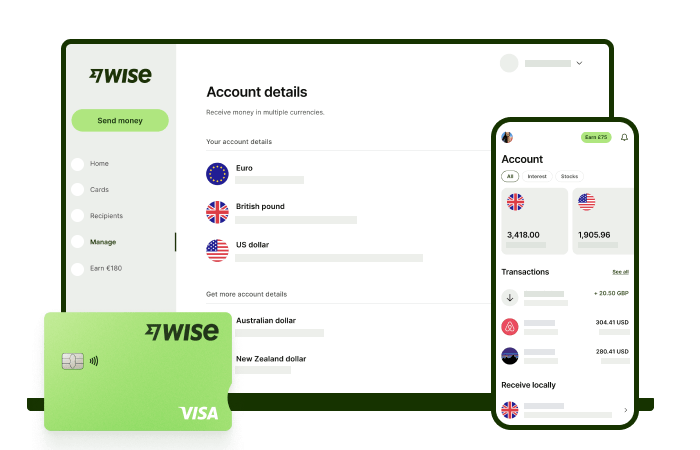

Finally, you can add a Wise account to your PayPal account to make payments and cash in if your account can hold a balance. Here’s how to cash in PayPal with Wise¹⁰:

- Log into the PayPal app and go to Wallet

- Tap Link a bank account

- Follow the instructions to add your card details

- Verify the account and initiate your transfer

Receive foreign currency and exchange it directly to pesos at the mid-market rate with Wise.

Sa Wise, makakakuha ka ng 8+ local account details, kasama ang PHP, USD, GBP, AUD at marami pang iba. Kaya, mas madali at convenient na makatanggap ka ng pera direkta. Mag sign-up ka lang ng libreng account, at mae-enjoy mo nang i-manage ang pera mo gamit lang ang phone mo.

Kapag natangap mo na ang pera mo, madali mo itong i-convert sa 40+ na currencies, with low fees, at sa mid-market rate - ito yung totoo at nakikita mong rate sa Google. Kasama na dito ang pag-exchange ng peso na may one-time conversion fee na nagsisimula sa 0.57%. Kitang-kita na agad yan upfront, walang patong o hidden fees.

Kaya, tumanggap, mag-exchange, at ilipat ang funds mo sa iyong local bank account gamit ang Wise.

It’s simple and stress free - and lets you keep on top of your finances no matter what you’re up to.

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Wondering how to top up your Maya wallet? Learn more about how to add money at 7/11, using GCash, using credit card, and more.

Wondering how to invest in the stock market? Find out how to buy stocks in the Philippines and what the best trading platforms are.

Learn more about how to cash out GCash credits in store, in 7-eleven, and at partner outlets.

Planning to get your first credit card? Learn more about the best credit cards for beginners in the Philippines including fees, benefits and more.

Here are the best credit cards in the Philippines that have free airport lounge access. More on benefits and requirements to decide which card is for you.

Here are the best credit cards in the Philippines that have free Marhaba lounge access. More on benefits and requirements to decide which card is for you.