Lulu Money Malaysia review - best international transfers?

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

You can make an IBG transfer with CIMB from your checking or savings account, to move money between your own accounts or send a payment to someone else in MYR. This guide looks at how to make a domestic transfer (IBG) with CIMB, including the CIMB IBG cut off time and how to check an IBG transfer status at CIMB.

Join us as we explore: what is an IBG transfer with CIMB, and why might you want to use one? We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

A CIMB Interbank GIRO (IBG) transfer is a digital transfer method, to move money from your CIMB account to another bank account in Malaysia¹. The IBG system is managed by PayNet, and allows you to move money between your own Malaysian accounts, or to send a payment to someone else in Malaysia by entering their banking information.

There is no CIMB IBG transfer fee when you set up your payment online and through the CIMB app². The IBG transfer time for CIMB is pretty fast - although this may not be the quickest way to send your local payment. Duitnow transfers are usually instant and can be a faster option for your MYR transfer if you’re in a hurry.

The IBG transfer time for CIMB depends a little on the time you submit your request.

CIMB has a series of cut off times throughout the banking day, and processes IBG requests in batches at several points during the working day³.

If you submit your IBG transfer request before the cut off time, you can be assured of a delivery time within about 6 - 8 hours. If you miss the last cut off time of the day, or arrange your payment on a weekend or holiday, the payment will start to be processed on the next working day and can arrive by 11am.

We’ll look at the different cut off times in more detail in just a moment.

You can make a CIMB IBG transfer in the CIMB app, or online, by logging into your account service. Here’s make a CIMB IBG transfer⁴:

Once you’ve sent an IBG to a recipient one time, their details will be remembered and you can select them from the favourites list next time, instead of needing to enter all the banking information again.

As we mentioned earlier, the CIMB IBG cut off time depends on when you submit your payment request. Here’s a summary:

| Transfer request time | Transfer delivery time |

|---|---|

| Monday to Friday before 5:00am | By 11:00am same day |

| Monday to Friday from 5.01am to 8:00am | By 2:00pm same day |

| Monday to Friday from 8:01am to 11:00am | By 5:00pm same day |

| Monday to Friday from 11.01am to 2:00pm | By 8:20pm same day |

| Monday to Friday from 2:00pm to 5:00pm | By 11:00pm same day |

| Monday to Friday after 5:00pm | By 11:00am next business day |

| Saturday, Sunday, Federal Territory Public Holiday (any time of day) | By 11:00am next business day |

*Details correct at time of research, 5th August 2025

Here’s how to check CIMB IBG transfer status by logging into your online or mobile banking service⁵:

- Log into your CIMB online or mobile banking service

- Select Pay & Transfer, and then Transaction History

- You’ll be shown a list of all transactions, categorised as Successful, Pending or Failed

- Look for the transaction you want to track, to learn its status

If you ever have an issue with an IBG transfer with CIMB, you can call the bank or drop into your local branch to get personal advice.

Unfortunately, if you need to learn how to cancel an IBG transfer at CIMB, you might be out of luck. If you make a CIMB transfer to a valid but incorrect account number the payment can not be cancelled or returned by the bank⁶.

If the bank cancels the transfer because you enter incorrect bank account information, the funds will be returned to you. If your incorrect payment is made before 12:30pm the money will be returned on the next banking day - if your payment is set up later than this, it’ll take 2 working days to get the funds back to your account.

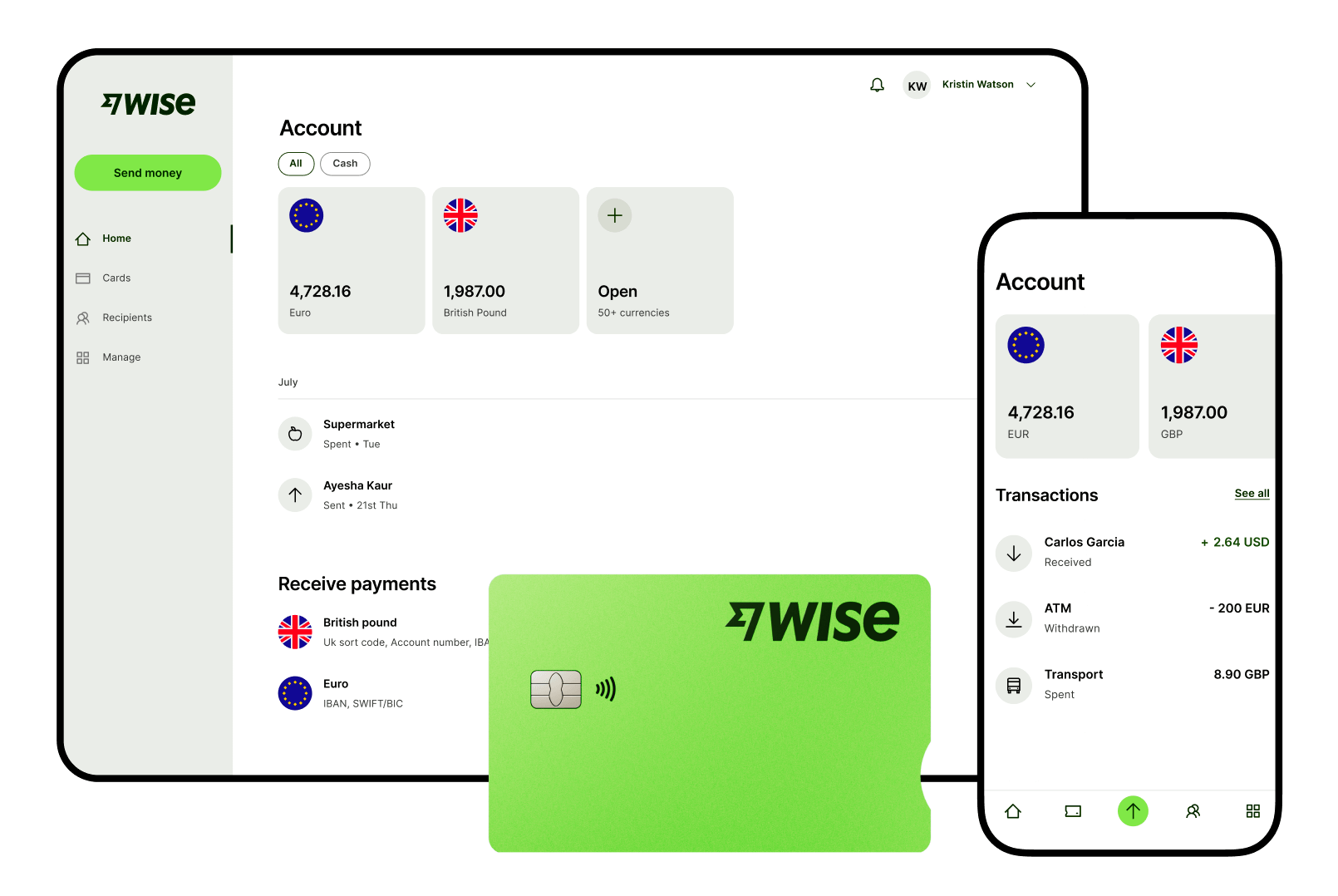

Wise international money transfers can be set up online or within the Wise app with low fees from 0.77% and the mid-market rate, to over 140+ countries. There’s no markup added to the exchange rate that’s used to convert your currency, which makes it easier to see exactly what you're paying for a transfer, and what the recipient will get in the end. Just transfer the amount indicated in MYR and let Wise do the rest.

Track your transfers easily when you create a free Wise account, and manage, hold, and convert your money in MYR and 40+ other currencies. You'll get the same great rates, and be able to track your transfers all from one place. As a bonus, you can also get 8+ local account details to be able to receive money in MYR, USD, GBP, and more.

Send money abroad - fast and fuss-free with Wise

Sources:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn more about how to use Lulu Money in Malaysia, as well as benefits, fees, and more.

Wondering how PayPal vs Wise compares in Malaysia? We compared the exchange rates, fees and features in our in-depth review of the two providers.

If you shop online, send or receive payments with PayPal, you should understand the transaction fees and charges in Malaysia. Read on for all you need.

This giveaway is only valid for customers in Singapore, Malaysia, Australia (except South Australia, Australia Capital Territory, Northern Territory), New...

Here's how to transfer money from PayPal to your Malaysian bank account from your PayPal account

Looking to make an international transfer with BigPay? We reviewed the fees and limits, and compared the cost with an alternative provider Wise.