Maybank Global Access vs Wise - which is better in Malaysia?

See how the Maybank Global Access account compares with Wise including fees, features and more.

Having a foreign currency account (also known as a multi-currency account) can be helpful if you need to send or receive international payments, travel often, or shop online with retailers based abroad. You can cut the costs of currency exchange and cross-border transactions, and minimise the risk of losing out due to changes in the exchange rate.

This guide walks through all you need to know about the Maybank Master Foreign Currency Account. We'll also introduce the Wise account, a handy companion to make your money go further with low, transparent fees.

| Table of contents |

|---|

Multi-currency accounts are available from traditional banks and specialist providers. With a multi-currency account you can hold, exchange, spend, send and receive payments in one or more foreign currencies as well as MYR.

Different accounts have different features and fees, but choosing the best multi-currency account for your specific needs can mean you cut the costs of international transactions and currency exchange.

Let’s look at some of the key benefits of the Maybank Master Foreign Currency account1, 2, 3:

| Master Foreign Currency Account features |

|---|

|

Before you decide if the Maybank multi-currency account is right for you, you’ll need to check the eligibility criteria and overall costs. We’ll cover eligibility in just a moment - first let’s take a look at the price you pay to open and operate a Maybank account.

The fees you pay include transaction fees, and a Maybank foreign exchange rate markup. You’ll also need to hold a minimum balance to open the account, and a higher balance to get interest on your savings. Here’s what you need to know.

Whenever you transfer money out of your Maybank foreign currency account into your regular account, you’ll need to convert it to MYR. This currency conversion will be done with Maybank’s live exchange rate which includes a markup on the mid-market exchange rate. That’s an extra fee which can push up the costs of currency conversion.

While adding a markup on the exchange rate offered to customers is common, some providers - like Wise - prefer to offer the real mid-market rate with clear, transparent pricing. That makes it far easier to see what you’re really paying for your transaction, and keeps the costs down, too.

Compare the costs of international transactions with Maybank against the price you pay with Wise.

Here’s a rundown of the key costs involved in opening and managing your Maybank multi-currency account:

| Fee/cost type | Maybank master foreign currency account charge |

|---|---|

| Opening fee | Free |

| Minimum opening balance | 1,000 USD³ |

| Monthly fee | Free |

| Minimum balance to earn interest | 5,000 USD |

| Transfer | 4 USD or currency equivalent + exchange rate markup |

You’ll need a minimum deposit of 1,000 USD or the currency equivalent to open your Maybank multi-currency account. To earn interest you need 5,000 USD or more in your balance. The interest rates available vary according to the currency you hold and are changed regularly⁴⁻⁵.

To open your Maybank Master Foreign Currency Account you’ll need to visit a local Maybank branch. A member of staff will confirm your eligibility for the account and walk you through the process of getting set up, including checking your documents and carrying out verification.

You can open an account as an individual or as a joint account with another Malaysian resident, or a non-resident who is an immediate family member. Here are the requirements for personal and business customers:

| Personal customers | Business customers |

|---|---|

| Be a resident of Malaysia aged 18 or over | Have a registered business, company, association, club, society or cooperative |

| Have or open a Maybank MYR checking or savings account | Have an introducer if not already a Maybank customer |

| Deposit at least 1,000 USD or the currency equivalent | Deposit at least 1,000 USD or the currency equivalent |

To open your Maybank foreign currency account you’ll need to also have or open a MYR checking or saving account. You can open several different types of checking and saving accounts online - but you’ll need to visit a branch to collect your account passbook, card and PIN.

Once you have your MYR account you’ll be able to set up your Master Foreign Currency Account in a Maybank branch. It’s a good idea to call the bank in advance and check exactly what documents you’ll need to bring along, based on your situation.

Generally personal customers need:

- Malaysian identity card or passport

- Valid visa or residence permit

- Letter of confirmation from your employer or educational institution

Business customers may need to provide:

- Memorandum and Articles of Association certified by the Licensed Company Secretary of the company

- Certificate of Incorporation

- Certificate to Commence Business, (for public limited companies)

- Names and addresses of company directors and secretary

- A resolution of the Board of Directors to open the account

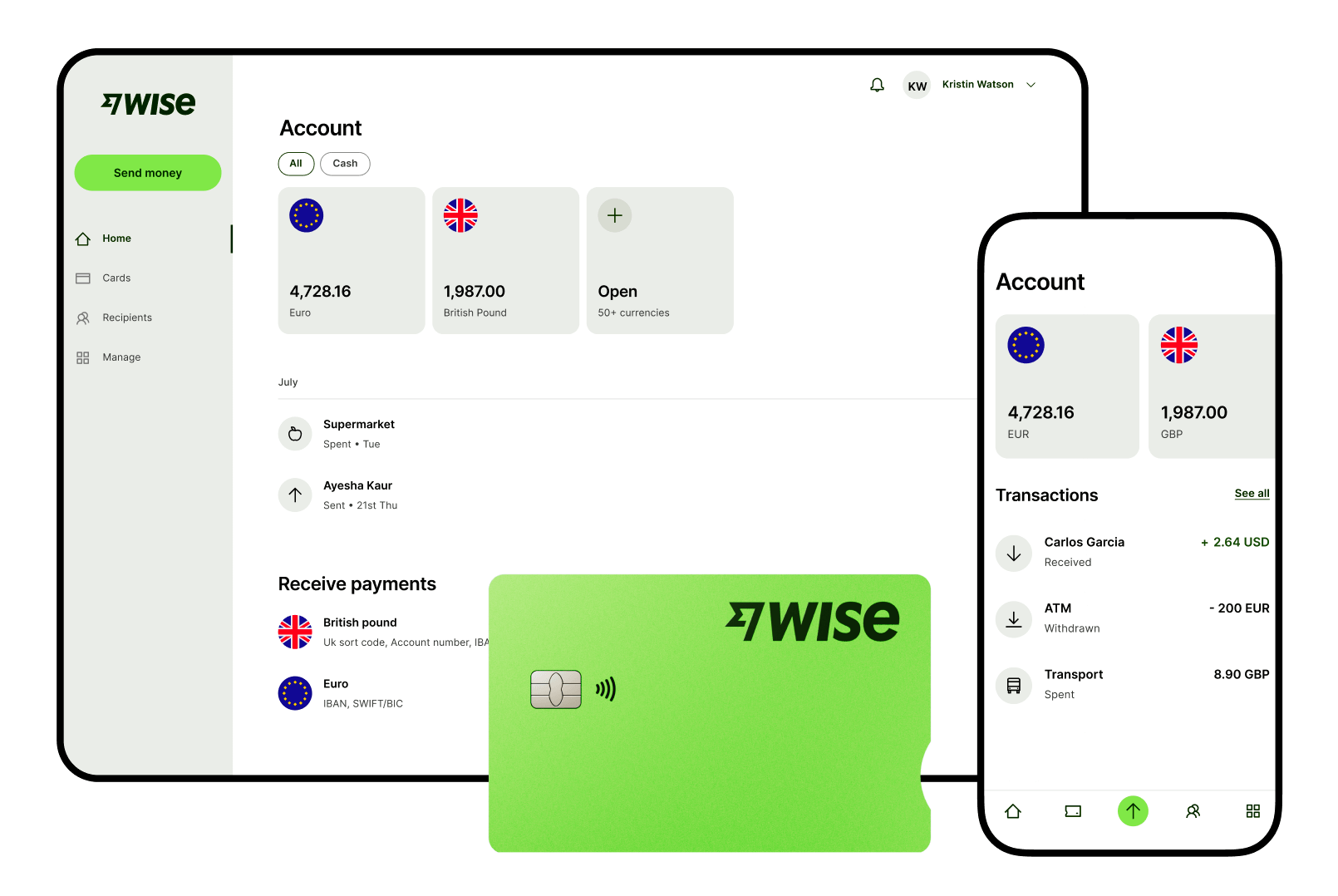

The Wise account is an easy way to hold and exchange 40+ currencies, including MYR, USD, GBP, and more. All you need to do is create a free account to get started.

With Wise, you can exchange currencies at the mid-market rate each time, with low, transparent conversion fees from 0.77% and absolutely no markups. Plus, you can order a linked Wise card for convenient spending without any foreign transaction fees, and up to 2 free ATM withdrawals to the value of 1,000 MYR when you're overseas. You'll even get 8+ local account details to get paid conveniently to your Wise account in MYR and a selection of other major global currencies.

Sending money or making payments abroad? Wise also offers fast, low cost transfers to 140+ countries - you can track your transfer in your account and your recipient will also be notified when a transfer reaches them.

The Maybank Master Foreign Currency Account lets customers hold funds in 16 currencies, with a minimum opening balance of 1,000 USD or the currency equivalent. Accounts are available for Malaysian residents who have a Maybank MYR account, and can be opened by visiting a bank branch.

If you’re looking for a more flexible multi-currency account with low fees and currency exchange which uses the mid-market exchange rate, check out the Wise account instead. There’s no minimum balance, you can hold 40+ currencies, and you’ll be able to manage your money on the go using the Wise app.

✍️ Sign up for a free account now

Sources

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

See how the Maybank Global Access account compares with Wise including fees, features and more.

Find out which are the best digital banks in Malaysia and how they compare.

Foreigner opening a bank account in Malaysia? Read more what options are available, documents needed to open a bank account and more

Looking to open a bank account online Malaysia? Read more about how to open a bank account or international account online and their requirements.

Looking to open a CIMB current account in Malaysia? Here's how to open an account with CIMB and review of each current account.

Need a local bank account in Singapore? Here’s how to open an account online in Malaysia, without leaving your home.