How to open a bank account in Switzerland from Ireland

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

Revolut is used by 3.1 million people in Ireland, and over 60 million people globally.¹ If you’re considering opening a Revolut account, it’s important to know if Revolut is safe to use.

With Revolut you can hold multiple currencies, send payments abroad, receive money from others, spend with a debit card and more. But is your money safe in Revolut, is Revolut safe to send money to other people overseas, and is a Revolut card safe for day to day spending?

This guide covers all you need to know about Revolut safety in Ireland - plus we’ll touch on how another provider - Wise - keeps customers safe with a powerful international account and card you can use for secure transactions around the world.

Let’s kick off with the most important point if Revolut is safe to use.

It’s natural to wonder how safe is Revolut, and you should certainly do your homework about any financial service you may use, to check they're legit.

As with any financial service provider, you’ll need to take common sense precautions when using Revolut, such as keeping your log in information and passcodes safe, and regularly reviewing your transactions - but in general you can rest assured that Revolut Ireland is safe to use.

Revolut operates in Ireland under a banking license issued by the Bank of Lithuania which allows it to provide services throughout the EU. It’s also covered by other major regulatory bodies, such as the FCA in the UK, although it may not have full banking licenses in other jurisdictions.²

So, is Revolut safe for holding money?

It’s helpful to know a bit about the way that EU banking licenses work. One important point is that banks which hold a banking license must follow very strict rules about protecting customer money, including ‘safeguarding’ customer funds.⁵

This requires banks to segregate customer money from their own operating funds, and to protect deposits under a deposit insurance scheme.

As Revolut is a regulated bank, your eligible deposits are covered by the Lithuanian Deposit Insurance scheme. This means that eligible deposits up to the value of 100,000 EUR (the legal maximum), are protected.³ In the unlikely event that Revolut went bankrupt, depositors are protected to this level.

So if your key question is: is it safe to keep money in Revolut? Again, the general answer is, yes. To the full extent of the law, your deposits are protected.

This publication is provided for general information purposes only and is not intended to cover every aspect of the topics with which it deals. It is not intended to amount to legal or financial advice on which you should rely.

| Read more: How does Revolut work in Ireland? |

|---|

Of course, safety isn’t just about licensing and regulation. Providers like Revolut also build in high levels of security features throughout their apps, websites, and processes. As Revolut is a digital first business, you can expect industry level safety features for your account, which can include:

In short, Revolut offers many measures that aim to ensure accounts can only be set up and operated by legitimate customers, then runs manual and automatic processes to detect and prevent fraud, and offers support 24/7 if you ever need help.² ⁴

All Revolut Ireland accounts offer a linked debit card, which also has a whole host of measures built in, aimed at keeping customers safe as they spend. Revolut card safety measures include:

🔎 But note: As with any debit card, you do need to keep your Revolut card safe in your end too.

| Read also: Wise card vs Revolut card |

|---|

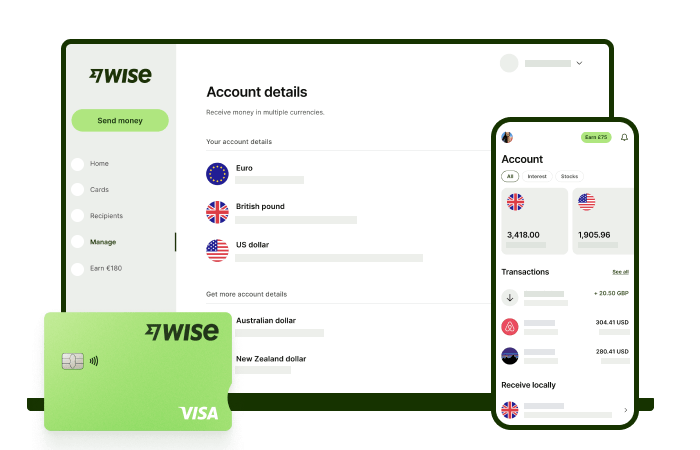

Other providers like Wise also work hard to protect customers and ensure you can transact safely, stress free.

Wise isn't a bank, in Europe it’s a regulated payment institution, registered in Belgium and authorised by the National Bank of Belgium, and has 65+ licences globally.

Wise Europe has put specific measures in place, to make it safe for the transactions you can make with a Wise Account. When it comes to holding your money, all customers' funds are safeguarded with trusted institutions, separate to Wise’s operating funds . This means it would be available even in the unlikely event the business got into financial stress.

Some other important Wise safety features include:

Sources used:

Sources last checked on date: 8th August, 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Can Irish citizens open a Swiss bank account as non-residents? Read all about it in this guide.

If you need a UK bank account, read this article, as it covers the requirements and documents needed.

Discover how you can open a bank account in Australia from Ireland, including the documents and steps.

What are the PayPal fees for consumers in Ireland? How much do you pay when sending money? Read here.

Read this guide on how to open a PayPal account in Ireland. Discover the documents, costs and more.

Discover how Revolut works in Ireland. Explore the mechanics of Revolut's operations tailored specifically for Irish customers.