DeepSeek pricing and model guide in the UK (2025)

Explore the complex DeepSeek pricing structure and learn how to cut down on unnecessary conversion fees when paying for your SaaS subscriptions with Wise.

Startups face many challenges, especially in those first few years when working towards building a viable business. One of the biggest hurdles will be profitability, where your new company actually starts making money rather than just breaking even.

But just how important is profitability for startups? We’ll explore this here, in our essential guide for UK founders and entrepreneurs. This includes a look at why profitability matters, how to calculate it and how long it typically takes for UK startups to turn a profit. And of course, we’ll cover profitability vs. growth, and which one you should aim to prioritise.

And whilst you're getting your finances in order, make sure to check out Wise Business. It’s a powerful business account suitable for companies of all sizes, that can make managing costs and funding more seamless.

Get started with Wise Business✈️

There are lots of reasons why startup profitability is important. It’s essential for all businesses, so it’s no wonder that many startups seek to become profitable as fast as they possibly can.

There are a few reasons why it matters:

Yes, profitability will always be an important metric for investors when weighing up whether a particular startup is a good bet.

Investors tend to use financial statements when assessing targets for investment. These offer a picture of the company’s financial health, including income statements, cash flow statements and balance sheets which show profit and loss.

With this data, they can evaluate the startups ability to generate profit and sustain growth. They can also determine the financial stability of the company, the efficiency of its cost management, and how much of a risk it may pose for investors.

However, growth can be just as crucial to investors as profitability. So if your startup isn’t yet profitable but has an effective and actionable plan for growth, it can still prove an attractive prospect for investors.

There’s no one-size fits all rule when it comes to when a startup will become profitable - if it ever does. In fact, around 5% of startups fail in the first year, and the majority fail within the first 4 years.¹

These will be statistics you’re well aware of as a founder, as starting a business from scratch has always been a risky and courageous thing to do.

So you already know that there’s no guarantee that your startup will ever become profitable. A number of different factors can also affect profitability, including:

The sector and nature of your business will also play a part in how soon your company will start to turn a profit.

But what about on average - how long does it take to become profitable as a UK startup? In many cases, it’s around the third or fourth year of operation.² You’ve passed through the launch, growth and break even stages, and finally reached profitability. For some companies, it happens even earlier. Some statistics have found that many new businesses start to turn a profit in as little as 18 to 24 months.³

In the startup world, particularly in sectors like tech which have heavy venture capital backing, growth is everything. There’s the risk that if you focus too much on building the bottom line and netting the cash, you’re not reinvesting profits into marketing, employees and other key elements needed for growth.

Prioritising growth has worked extremely well for some of the world’s most successful startups, many of which have grown into major corporations - from Amazon to Salesforce.

These companies may have spent years operating at a loss, because they ploughed any and all revenue into reaching aggressive growth targets. Once these were achieved and the companies grew, it was only then that they started making profits - but the profits were enormous, making any pain suffered in earlier years well worth it.

With business models like this to follow, it’s no wonder that many startups see growth-above-all as a winning strategy for long-term success. But there’s also another school of thought, one which claims that the best strategy is to find a good balance between growth and profitability.

Focusing on profits may even suit some startups better. Successful entrepreneurs such as former NerdWallet CFO Laura Onopchenko explained in a Silicon Valley Bank article that for that company, a focus on profits led to making better long-term decisions. She described one of the reasons for this as “the ability to control our own destiny”.⁴

As a founder, it’s absolutely essential to have a firm grasp on how your startup is performing financially. This means knowing how to accurately calculate operating profit.

This is the total earnings from your core business over a particular period, before deductions such as tax or expenses are made. For this calculation, you’ll exclude profits from non-core business activities. If your core business income is higher than your expenses, it means you’ve made operating profit.

The formula for calculating operating profit is:⁵

Operating Profit = (Total Revenue) – (Cost of Goods Sold) – (Operating Expenses) – (Depreciation) – (Amortisation).

It isn’t just profitability that startups should be tracking. If you have an eye on growth as well as profitability and other targets, you may also want to look at other metrics such as:

And if you’re trying to find the right balance between growth and profitability, there are some industry-specific rules of thumb you can research.

For example, Software-as-a-Service (SaaS) companies use something called the Rule of 40. This is a principle stating that a company’s combined revenue growth rate and profit margin should be at least 40%. This indicates that profit is being generated at a sustainable rate. Companies falling below this 40% mark may struggle with cash flow or liquidity in the future.⁶

While you’re focusing on bringing in revenue and profit for your startup, it’s also worth making sure you’re set up with the right business account.

Open a Wise Business account and you can hold and exchange at once.

You can send fast, secure payments to , and get account details to get paid in like a local.

Whenever you need to send, spend or exchange foreign currencies, you’ll benefit from the mid-market exchange rate, with low, transparent fees.

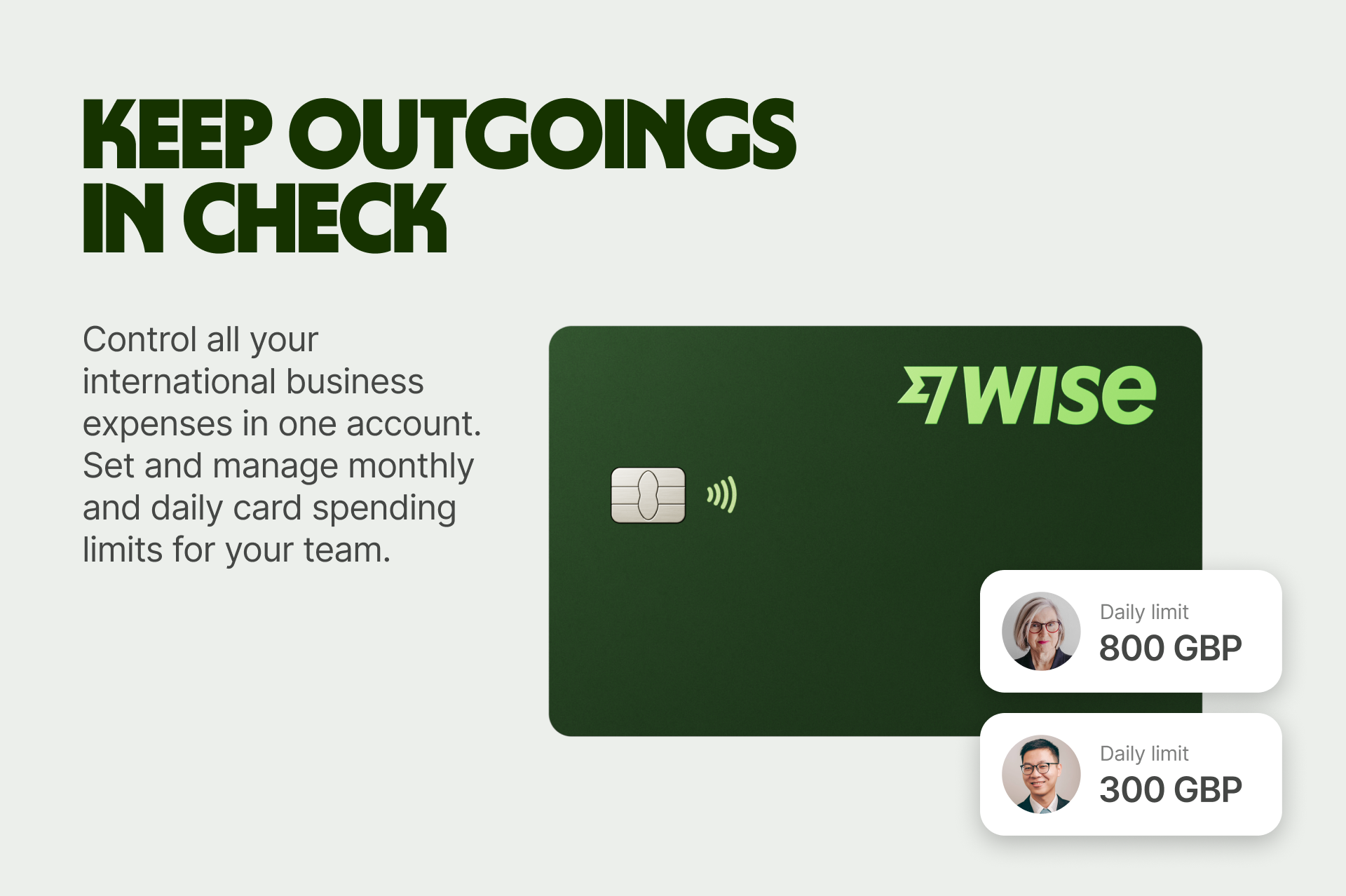

You’ll also benefit from all of these features with Wise Business:

With a truly global account, you’ll be all set to grow your business worldwide.

Get started with Wise Business✈️

After reading this, you should have a better idea of how important profitability is for UK startups - and be able to decide whether you want your company to focus on profits, growth or find a balance between both.

Sources used:

Sources last checked on date: 01-Sept-2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Explore the complex DeepSeek pricing structure and learn how to cut down on unnecessary conversion fees when paying for your SaaS subscriptions with Wise.

Learn how Fiverr payments work for UK contractors and buyers, including fees, withdrawal options, and how Wise can help you save on international payments.

Learn how payments work on Upwork in the UK, from available payment method, fees and tips for handling foreign currencies.

Find out how to create a cash flow forecast for your UK business in 5 simple steps, here in our handy guide.

Thinking about raising funds for your startup? Learn more about the pros and cons of angel investment and whether it will work for your startup.

Learn how Business Asset Disposal Relief can reduce your Capital Gains Tax. See who is eligible and what has changed in 2025.