Best international payroll providers in 2025

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Having a solid corporate tax plan is essential for small businesses. It helps them navigate complex tax regulations, reduce their tax liabilities, forecast their tax obligations, ensure timely and accurate filings, and streamline cash flow management.

In this article, we explore some of the best practices for corporate tax planning, with a particular focus on businesses in the UK. We also highlight Wise Business, an international account enabling you to send and receive business payments abroad in multiple currencies. Wise Business offers cost-effective currency conversions using the mid-market exchange rate.

💡 Learn more about Wise Business

Corporate tax planning is simply the process of structuring a company's financial affairs to minimise its tax liability while ensuring compliance with tax laws and regulations.

For businesses in the UK, having a solid corporate tax plan helps them manage their company’s tax liability while ensuring that they meet the HMRC obligations. This process involves employing strategies such as deferring income, maximising deductions, and picking a favourable tax jurisdiction to reduce a company’s tax bill while increasing profits.

For example, let’s say a construction company based in Nottingham wants to minimise its tax liability for the next tax year. This year, the company has an annual income of £50,000. By deducting £10,000 in allowable expenses such as labour, supplies, transport, and utilities, the construction company’s taxable income is reduced to £40,000, significantly lowering its tax bill and helping it save money.

Here’s a quick walkthrough of how corporate tax planning works:

First of all, you need to evaluate whether your current business structure is tax-efficient or not. For example, operating as a limited liability company helps you minimise your tax liability compared to when you’re operating as a sole trader. This is because income tax can be up to 40% if you earn £50,271 to £125,140¹. On the other hand, corporate taxes in the UK are usually within the range of 19% to 25% depending on how much your profit is².

Ensure you have a clear understanding of your tax obligations. Knowing your tax obligations helps you be compliant with the UK local corporate tax laws and avoid penalties and sanctions from non-compliance.

More importantly, understanding your tax obligations enables you to know how much tax you owe, when you need to file your tax, and if there are any tax reliefs you can claim to reduce your tax liabilities.

Businesses with profits above £250,000 are obligated to pay a corporate tax of 25% on profits. Companies with profits at or below £50,000 are obligated to pay a Small Profit Rate of 19%².

Businesses in the UK can also explore different tax relief schemes to reduce their tax liabilities. For instance, companies in the innovation sector can leverage the R&D tax credits⁵. Likewise, you can also check if you are eligible for the creative industry tax relief⁷.

Why is corporate tax planning important for businesses?

Here are some of the major reasons why having a corporate tax plan is essential:

For companies seeking to minimise their tax liabilities, effective corporate tax planning strategies are crucial.

This section highlights some of the most effective corporate tax strategies that small businesses can consider:

Here are some of the best corporate tax planning tools for you to consider for corporate tax planning:

Xero: Xero is a corporate tax tool that provides profit and loss reports for viewing your company’s income, expenses, and profits⁹. Not only that, this software allows you to customise the report by year, month, and date comparison. Xero offers some of the following features¹⁰:

Sage: Sage is a tax software designed specifically for small businesses¹¹. This software program is equipped with a simplified dashboard that gives you full visibility of your cash flow. It also helps businesses make informed decisions with business reporting insights.

QuickBooks: QuickBooks’s dashboard provides a real-time overview of your tax-related expenses¹². It allows you to customise invoices and run reports from one place.

Having a well-structured corporate tax plan can help you:

Are you looking to write a corporate tax plan for your organisation? This section outlines a step-by-step guide on how to write one:

Create a complete overview of your company’s structure, industry, size, income streams, annual turnover, and your tax liability. Knowing this information helps you determine your tax position and which tax rules are applicable to your business.

Clearly define what you plan to achieve by having a corporate tax plan. Is it to minimise tax liabilities or improve cash flow, or even stay more organised and file taxes without a last-minute rush?

Identify all the tax reliefs and allowances your business can claim. Additionally, ensure that you list the criteria for each relief and allowance. Doing this ensures that you don't miss out on any tax relief opportunities to reduce your tax bill.

Create a detailed tax calendar for all your tax deadlines. With this calendar, you can easily track and manage all your tax events and ensure that you are not missing any deadlines.

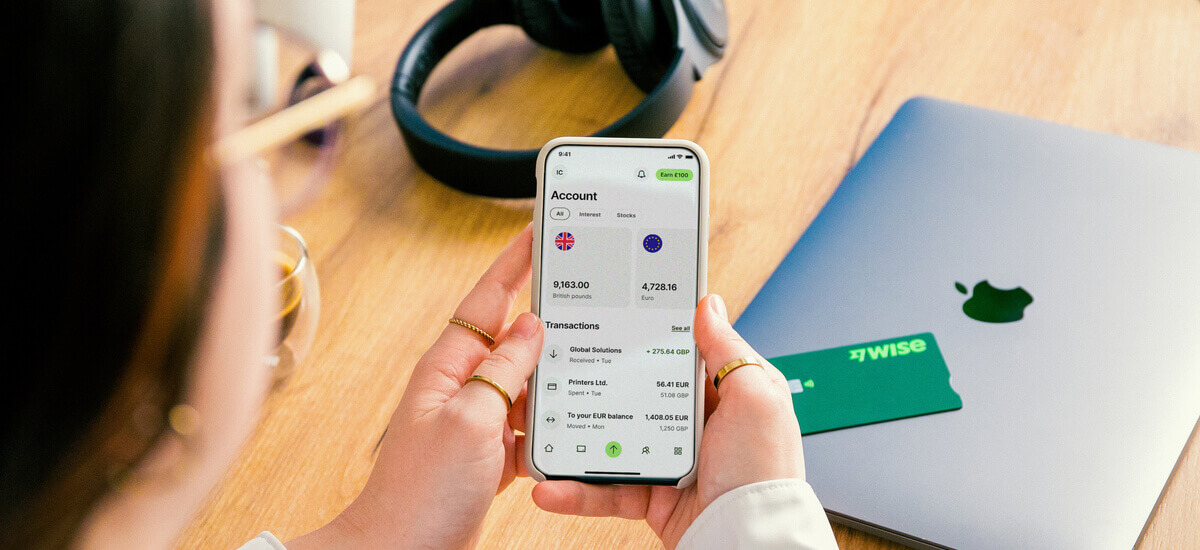

Wise Business can help UK businesses to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

Wise Business account connects with Xero, QuickBooks, FreeAgent, FreshBooks and more solutions to help you seamlessly manage your finances across borders.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

Below are some of the frequently asked questions on corporate tax planning:

The main objective of having a corporate tax plan is to minimize a company’s tax liability while ensuring that the business stays compliant with corporate tax laws. This process involves using strategies like claiming tax relief, deductions and allowances to legally save on a company tax return and increase their after-tax profits.

Additionally, a corporate tax plan helps companies streamline their cash flow, minimise non-compliance risks, and ensure financial transparency.

Tax compliance involves companies fulfilling their tax obligations. This includes filing tax returns on time and keeping accurate records to be compliant with HMRC regulations. Doing this helps organisations avoid fines and penalties that non-compliance might attract.

Changes in tax laws have a significant impact on your company’s tax plan. For example, a slight adjustment to the corporate tax rate by the HMRC will mean your company will have to update your tax strategy accordingly to reflect this new update.

Therefore, it’s advisable for businesses to be updated with changes by local tax bodies like the HMRC.

Ideally, an organisation should review its corporate tax plan at least once a year. This should be before the end of its accounting or tax year. However, as your business grows, it’s advisable to revisit your corporate tax plan strategies more regularly.

Poor corporate tax planning can put your organisation at various financial and legal risks. It can lead to reduced cash flow and profits because your business fails to claim deductions and allowances that they are entitled to.

Additionally, this may result in your company facing fines and penalties due to non-compliance with HMRC’s regulations.

Sources used in this article:

Sources last checked 19/08/2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about the top international payroll providers, their features, pricing, customer reviews and how to choose the right provider for your business.

Here’s an objective review of the best corporate tax software for International Businesses. Learn about their features, prices and ratings.

There are several reasons why international investment is appealing to UK startups at the moment. With economic uncertainty prevailing, the impact of Brexit...

Digital Product Passports are reshaping EU trade. Discover what’s required and how Wise Business makes compliance more cost-effective.

Learn how to start a business in Mexico, focusing on opportunities and regulations to navigate for successful operations.

Discover the 10 best European cities to start or grow your business in 2025 with funding, talent, and speed you won’t find in the UK.