Hunter.io pricing and plans guide for the UK (2025)

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Whether you use the term cashflow management or not, you’ll already be managing your cashflow as part of your business. This guide is here to help you identify how you approach cashflow management and build a more robust system to help your business thrive. In this guide we’ll look at:

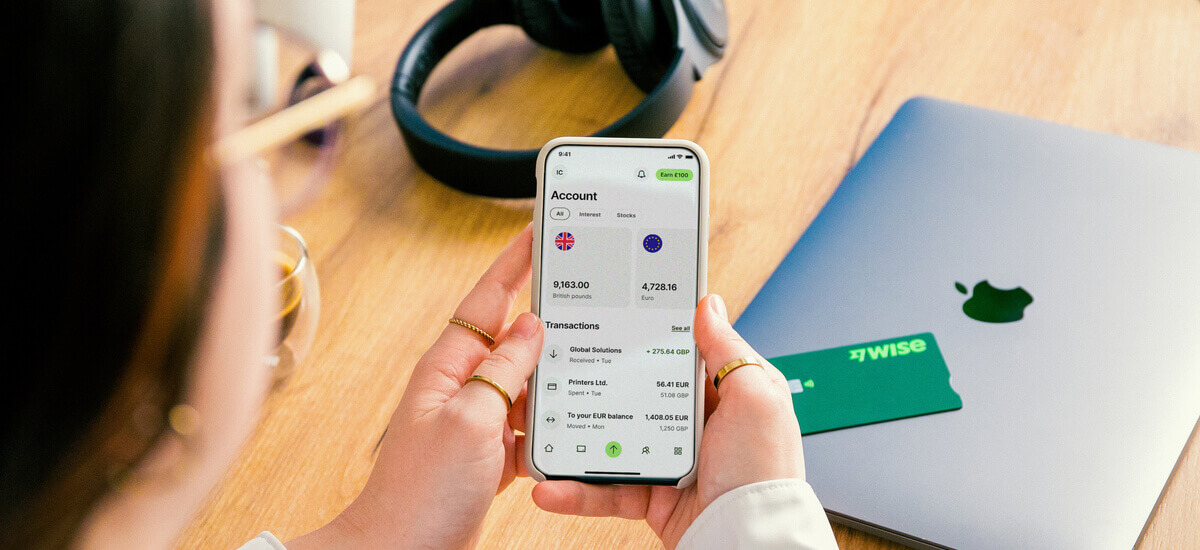

Wise Business makes cashflow management easy - even in multiple currencies - by integrating with some of the biggest accountancy software, allowing you to see your Wise bank feeds in real-time and plan ahead.

💡 Learn more about Wise Business

Cashflow management gives you the ability to look ahead and make sure that you have enough money to pay your bills, any contractors or employees, any debts and yourself as the business owner.

If you find this stressful as a business owner, you’re not alone. A 2019 study by Xero and PayPal found that 43% of small business owners¹ have been awake at night worrying about their business’ cash flow. As a result, it’s important for business owners to understand cashflow management and use it accordingly to protect their mental and physical health and make their business more resilient.

Cashflow management works by tracking and analysing all the money coming in and out of your business. To do this, you’ll need to keep a list of all your expenditure and income over a set period of time. If you have more cash coming into your business than going out, you’re in positive cash flow. However, if the reverse is true, you’re in negative cash flow.

Cashflow is what keeps your business alive. It helps make sure you have enough money to pay your bills each month. It makes sure you’re not spending money before it hits your account. It helps you plan ahead for months when you may have more outgoings or quieter months.

Cashflow management is important for businesses for a number of reasons. On a practical level, it can be the difference between your business continuing or not with research from the Federation of Small Businesses estimating that 50,000 small and medium businesses go out of business in the UK each year and cite cashflow as a cause². Effective cashflow management helps you plan for future events, invest in your business growth, and gives you a safety net so that you can operate with confidence.

There are three common types of cashflow categories. Depending on your business, you may use all of them or just one. Let’s take a look at them.

This is the money that comes in and out of your business through your day-to-day business activities. Money may come into your business via:

Cashflow expenditure in this category may include:

Refers to long-term assets which tend to cost more than your day to day expenditure. Examples of outgoing money from investments include:

On the other hand, if you sold old equipment, this would count as incoming cash.

There may be times where your cashflow from investing is a negative cashflow. This isn’t necessarily cause for alarm but is rather an indication that you are prioritising growth and development at this moment in time.

The final cashflow category is cashflow from financing. This is when you bring money into your business by either bringing investors on board or borrowing money. Incoming money in this category may include:

Outgoing expenditure in this category can take the form of:

While the concept of cashflow management can initially feel confusing, it’s likely that you’re already doing a number of things to manage your cashflow. This article is really designed to help you identify what you’re already doing well, spot any gaps in your system, and give you confidence as you continue to run your business. With that in mind, let’s explore some cashflow management strategies you can employ in your own business to make the process easier, quicker, and smoother.

You can’t plan if you don’t know what’s coming. Keep tabs on the money you expect to be coming in and out of your business to spot any shortcomings before they crop up. When you’re tracking your spending, make sure you consider both your monthly expenses and any annual recurring expenses.

Your clients can only pay you if they have an invoice from you. Make sure you send your invoices regularly either immediately after you complete the work or once a month. It’s wise to keep your payment terms as short as possible so there’s less time between sending your invoice and getting paid.

Have a system in place to chase up any late payments so you don’t miss out on receiving the money you’re owed. Many accounting software tools will be able to automate this for you, taking out that awkward feeling.

We can all end up with those subscriptions we don’t use any more and forget to cancel. Build a regular spending audit into your calendar so that you can cut down on any spending which is no longer serving your business.

Having a cash buffer can protect you from any unexpected bills or a quieter month. We recommend aiming to save one to three months worth of expenses to give you peace of mind and flexibility.

The good news is that there are a number of cashflow management tools which can make this process easier and quicker.

Xero

Xero is one of the leading accounting software management tools and provides you with a range of useful features. Send invoices in a couple of clicks, set up automated invoice reminders, and view your bank feeds live.

FreeAgent

FreeAgent is designed for freelancers and allows you to visually see your cashflow and tax timeline. FreeAgent also lets you set up automated invoice reminders, freeing up your head space for other matters.

Notion or Google Sheets

Using Notion or Google Sheets is ideal if you want to build your system or you’re looking for a budget-friendly option.

One of the most common ways people get confused with their cashflow management is by thinking that that profit is the same as cash. No matter how much you’ve invoiced, if you’re spending more than the money in your account, you’ll quickly end up having a negative cash flow,

Forgetting to budget for tax can also affect your cashflow as a sudden large bill can knock you off balance. To avoid this, we recommend saving for your tax bill all year round. There are some business bank accounts such as Monzo, Mettle, and Starling which will allow you to set aside a percentage of each payment in a tax pot.

It’s also important to have that emergency fund cash buffer in place to build resilience in your business. Without this protective measure in place, a non-paying client or a piece of equipment breaking down could lead to an immediate cashflow crisis. Having this safety net gives you an ability to adapt to whatever life throws at you.

Finally, make sure that you’re checking in on your finances regularly. We all know that’s what in our heads doesn’t always match reality. Combat any “optimistic” thinking by checking in on your finances regularly and spotting any warning signs before they become big issues.

Wise Business can help UK businesses, freelancers and sole traders to manage finances across multiple currencies, with low fees and the mid-market exchange rate.

Wise Business account connects with Xero, QuickBooks, FreeAgent, FreshBooks and more solutions to help you seamlessly manage your cash flow across borders.

When you open a Wise Business account, you’ll benefit from all of these useful features:

Get started with Wise Business 🚀

The primary goal of effective cash flow management for a business is to make sure that you always have enough money to pay your bills and salary. An effective cash flow management process reduces stress, gives you confidence, and allows you to make smarter financial decisions. It’s not about restricting you but rather giving you the freedom to spend as and when you need to.

Forecasting cashflow is important for businesses as it helps you to plan your spending and make sure that you don’t run out of money. It also means that you can plan with confidence, knowing you have the money to upgrade your equipment as needed, bring on staff, or are prepared for any emergencies. It also gives you the real data so that you can plan when to spend and when to save.

Accounts payable automations work by allowing you to digitally manage, streamline, issue, and pay invoices. This automation can improve your cashflow management by giving you better visibility of your accounts, letting you see real-time data and plan for upcoming expenses. It can also help you speed up payments without making expenses as the software will flag any duplicates or errors. This improved performance and fewer human errors means that forecasts are more accurate, giving you the power to make better business decisions.

Technology can improve cashflow management systems in a number of ways. One of the biggest benefits is access to up-to-date and accurate information, so that you never have to make another financial decision based on an estimate or what you think you have in your account.

Software technology can also free up both headspace and time by automatically sending out invoices and payment reminders so that you get to tick off a critically important job from your to-do list without doing the work. Most accounting software options now have mobile apps too, allowing you to access your data any time, see the latest forecast, and plan accordingly. Finally, accounting software is equipped with multiple integrations such as including your bank feeds and your customer relationship management tool. This means all your key information can be accessed from one place and your tools all communicate with each other, saving you time.

As ever, this can be slightly variable depending on how your business operates. It’s worth reviewing your cashflow on at least a monthly basis. This helps you keep an eye on any overdue invoices, ensure you have enough cash to cover the expenses that month, and plan ahead for expensive but less frequent items like your tax bill. It can also inform your own pricing structure and make adjustments as needed.

For many businesses, you may want to break this down into weekly check-ins so that you can spot any potential issues before they develop and to make the task more manageable. At the other end of the spectrum, adding in a bigger picture quarterly reviews can help you plan your more long term goals and where you want to invest in your business.

Cashflow management can often be overlooked or not seem relevant until something goes wrong. However, establishing a transparent and effective system can make a huge difference to you and your business. When a cashflow management process is in place you can plan with confidence, knowing that you won’t run out of money and making minor course corrections rather than spotting a flaw when it reaches a crisis point. It can also help you invest in and grow your business as you know the resources you have available and what you’re likely to earn and spend in the short to medium term. With accounting software, you can manage your cashflow with ease, basing decisions on real-time data and hard figures. Have clients in multiple countries? A multicurrency Wise business account could help you manage your cashflow in the currencies you use.

Sources used:

Sources last checked on 15-Sep 2025.

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Learn about Hunter plans and pricing to find the right plan for your business and streamline your lead generation.

Learn about Lumen5's pricing, plans, and features. Find the right subscription for your needs and get tips on how to save money on your account.

Learn how to set winning rates for social media management. Our 2025 guide covers pricing packages, retainers, and strategy to maximise your freelance income.

Unlock your earning potential with our freelance SEO pricing guide for 2025. Learn how to set profitable rates, factors that affect pricing, and more.

Find and retain high-value clients for your freelance work. Our guide explains proven strategies to secure long-term revenue and grow your freelance business.

Find out how much to charge for freelance photography. Our 2025 guide breaks down pricing for portraits, events, commercial work and more.