How to open a Resona Bank bank account online | Step-by-step guide

Open a bank account with Resona Bank following these easy steps! Standard fees including ATM fees, International transfer fees, required documents explained

This article was reviewed on July 25, 2025. Information may have changed since publication, please verify with the relevant provider. Wise Payments Japan is not affiliated with SBI Bank. This content is for informational purposes only and does not constitute financial advice. Please use your own judgment when making decisions.

Opening a bank account in Japan can be challenging for non-Japanese speakers, but don’t worry! There is a banking option for foreigners where you can open an account online. Make sure you have a legal residence first, since you will need the Residence Card (zairyu card) to register for a bank account.

This article will guide you on how to open an SBI Bank account online and list required documents and fees for you to get ready. Check out our guide for a list of other banks you can find in Japan.

| Table of contents |

|---|

Yes! Good news, a foreigner could open a bank account with SBI. As long as you are a resident of Japan and own a personal Japanese telephone number, you can make an account.¹

SBI is a commercial bank in Japan and its modern financial institution, SBI Shinsei Bank has a PowerFlex Account, which offers English online banking and 24/7 support.²

PowerFlex Account has many advantages including:²

Attention: there are times when PowerFlex Account service is not available due to the system maintenance.

Eligibility to open account: ¹

Read the Confirmation of Resident defined under the Foreign Exchange and Foreign Trade Act for more details.

| Item | Branch | Powercall |

|---|---|---|

| Fees | Fees | |

| Account maintenance | Free | Free |

| Reissuing monthly statement | Free | Free |

| Reissuing cash card for damage | Free | Free |

| Reissuing lost or stolen cash card | 1,050JPY | Free |

| Changing cash card colour | 1,050JPY | 1,050JPY |

| Rank | ATM | Fee |

|---|---|---|

| “Silver” customers |

| Free |

| “Standard” customers |

| Free up to 5 times per month |

| “Silver” customers |

| JPY110 (including tax) |

| “Standard” customers |

|

| Transfer type | Destination bank | Fees |

|---|---|---|

| Fund transfer | To SBI SHINSEI BANK | 529JPY |

| Domestic fund transfer | To other domestic bank | 529JPY |

| Refund for failed domestic fund transfer | - | 524JPY |

Fees above subject to consumption tax include 10% consumption tax and local consumption tax.

Other fees may apply for non-SBI SHINSEI BANK account holders, please verify with the Provider.

| Remittance fees for GoRemit overseas remittance service | ||

|---|---|---|

| Withdrawing from a PowerFlex account via GoRemit app | From a foreign currency Savings account | 4,000JPY |

| (Same as the above) | From a Yen savings account | 2,000JPY |

| Depositing funds to SBI collection account (JPY) | Remittances in foreign currencies | 2,000JPY |

| (Same as the above) | Remittances in JPY | 2,000JPY + Lifting fee of 0.1% of the remittance amount (Min. 1500JPY) |

| Incoming foreign exchange remittance administrative fee | |

|---|---|

| Currencies | Fee (Tax-exempted) |

| Japanese Yen | 2,000JPY |

| US Dollar | 13.00USD |

| Euro | 12.00EUR |

| Australian Dollar | 21.00AUD |

| New Zealand Dollar | 22.00NZD |

| Canadian Dollar | 18.00CAD |

| Hong Kong Dollar | 105.00HKD |

| Singapore Dollar | 18.00SGD |

| South-Africa Rand | 228.00ZAR |

| Norwegian Krone | 148.00NOK |

| Turkish Lira | 556.00TRY |

| Chinese Yuan | 99.00CNY |

Online application can be done through SBI Bank’s Power Direct—the online banking system that can be used via PC or Smartphone. When opening a PowerFlex bank account, make sure you have all required documents for your application. U.S. citizens will be required to provide additional documents.

Photocopy of front side only

Notification card cannot be accepted

OR

Original copy of one of these:

The identification documents for customers who are 18 years old or older will differ from customers under 18 years old. Check out here for more information.

All branches of SBI Shinsei bank are open from 9:00 am to 5:00 pm on weekdays. Only asset management consultations through appointment are available on Saturdays.⁶

Click on the link below to access contact numbers of SBI banks in Japan.

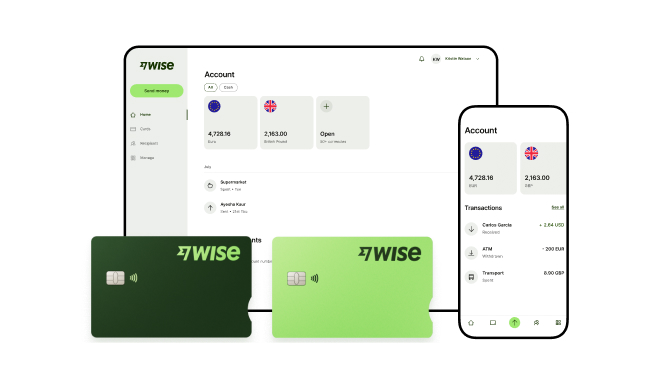

You can also open a Wise accountonline where you could exchange yen to different currencies and transfer funds smoothly at low cost. Since Wise uses mid-market rate, you can exchange currencies with a competitive fee. Wise card will also let you withdraw cash from ATMs and let you pay in different currencies. If you don’t have an address in Japan yet, or want to quickly open an account, Wise can be your option!

Check out the benefits of Wise below:

| Benefits of using Wise |

|---|

|

Some key takeaways:

Disclaimer: This article is not sponsored by or affiliated with SBI and has only been reviewed by Wise, not the bank. For more information, please be sure to visit their website.

Source:

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Open a bank account with Resona Bank following these easy steps! Standard fees including ATM fees, International transfer fees, required documents explained

What are the steps and required documents you need to open an SMBC Prestia bank account? International transfer fees explained.

If you’re considering opening a bank account in Japan you’re in the right place. This guide covers the documents you need, the basic process to follow, and...

Yucho internet banking is the Japan Post Bank service which allows customers to check and manage accounts, make transactions and send payments online. You can...

With Shinsei PowerDirect - the Shinsei online banking service - customers can access and manage their accounts any time, using their smartphone or...

Learn about opening a bank in Japan as a foreigner - which bank to choose, what documents to collect, and how to save money with Wise.