Best high-interest savings account in Australia: 2025 Comparison

Compare the best high-interest savings accounts in Australia. Our guide breaks down interest rates, and fees to help you find an account to grow your savings.

Founded in 2015, Revolut is a British fintech company that expanded into the Australian market in 2019.¹ They offer a range of financial services, all managed through a user-friendly app.

In this guide, we’ll walk through the products and services available from Revolut, as well as the fees and costs you’ll need to think about. For comparison sake, we’ll also see how it measures up with Wise, to help you decide if Revolut is the right solution for your needs.

| Table of contents |

|---|

Revolut is a financial services provider that aims to provide a digital environment where people can manage all things money, from spending and saving, to investing, borrowing and handling multiple currencies.¹

One of the core features of Revolut is the multi-currency account, and offers Australian customers a choice between 4 different account types for personal use. There are also options for business customers. All Revolut accounts hold 30+ currencies, and come with linked physical and virtual cards for local and international spending and cash withdrawals. The exact account features you can get will depend on the plan you pick, more on that later.

Revolut Australia is registered as a local company and it is authorised by the Australian Securities & Investments Commission (AFSL & Australian Credit Licence number 517589). It’s worth noting though that their cryptocurrency and commodities products are unregulated in Australia, so aren’t provided under the AFSL license.

Looking at the security of the app itself, there are multiple features and systems in place to help keep your money safe.²

Based on this, Revolut is generally considered a safe option for Australian customers.

With a Revolut account you can access features to help with money management in multiple currencies. Your account can be opened as an individual or joint account, and be used to send, receive and hold funds, as well as invest and save.³

At the moment Revolut has four plans available to Australian consumers:³

- Standard - no monthly fee

- Plus - $5.99 per month fee

- Premium - $11.99 per month fee

- Metal - $28.99 per month fee

You can open an account and manage your money and plan from your smartphone; there’s no web access available with Revolut. As you go up the paid tiers you gain access to different features or perks, and there are some differences in the fee structure as well.

With all of the Revolut account plans you have access to these features:

- Exchange and hold 30+ currencies using the Revolut exchange rates

- Send money to multiple countries around the world

- Chat, send and receive money with other Revolut users instantly

- Put money aside in Pockets to help you save and budget

- Invest in stocks or crypto

- Have access to virtual and physical Revolut cards

Account holders with higher tier plans may also have access to perks like travel insurance, priority customer support and discounted airport lounge access.⁴

Jumping into the costs associated with having a Revolut account, here’s some of the main fees to know about. As you can see, they do vary depending on the Revolut plan you select.⁴

| Fees | Standard | Plus | Premium | Metal |

|---|---|---|---|---|

| Monthly fee | Free | $5.99 | $11.99 | $28.99 |

| ATM withdrawals | $350 or 5 withdrawals per month free then 2% fee per transaction | $350 per month free then 2% fee per transaction | $700 per month free then 2% fee per transaction | $1400 per month free then 2% fee per transaction |

| Currency exchange fee⁵ | $2000 per month free then 0.5% fee per transaction | $6000 per month free then 0.5% fee per transaction | $20,000 per month free then 0.5% fee per transaction | No fee |

| Additional weekend currency exchange fee | 1% | 0.5% | No fee | No fee |

| International transfer fees | Variable fee depending on country and currency | Variable fee depending on country and currency | Variable fee depending on country and currency with a 60% discount | Variable fee depending on country and currency with a 80% discount |

One of the other main fee structures to be aware of is the physical Revolut Card fees. These can be applied to a few different services based on the plan you select, the type of card you have (metal, plastic, custom etc) and if it’s a new or replacement card.⁵ Virtual Revolut Cards meanwhile are free to generate or replace, just like the virtual Wise cards.

Revolut uses its own variable exchange rate, which you can check directly in their app.³ While this rate can be competitive during weekdays, it's crucial to understand how it compares to the mid-market exchange rate – the true rate you see on Google, without any hidden markups.

A significant difference impacting your costs is the weekend. Out-of-hours fees of up to 1% apply on weekends depending on your plan and Revolut defines these weekend hours as Friday 5 PM to Sunday 6 PM, New York time.⁵ Keep in mind that this time could vary throughout the year when changed to Australian timezones due to daylight savings, potentially leading to unexpected charges.

For a consistently transparent approach that avoids these additional charges, Wise, another popular multi-currency account provider, operates differently. Wise applies the mid-market rate for all currency exchanges regardless of the day or time. Its low, transparent fees are always shown upfront, ensuring you know exactly what you're paying.

You’ll need to compare the overall currency exchange costs based on how you expect to use your account. Higher exchange fees mean your international spending costs you more, so choosing the account plan or provider which is cheapest for the types of transactions you’ll make often will help you lower your costs.

If you’re looking for a financial services provider that offers international money management tools, then Revolut is a viable option. They’re rated 4.5 stars on Trustpilot, with customers appreciating the easy to use app and convenience. That said, some do express concerns about the fees and customer support.⁶

When choosing a new provider it’s always worth considering the pros and cons, so here’s a few positives and negatives of using Revolut.

| Pros | Cons |

|---|---|

|

|

Revolut offers a feature-packed money app for Australians looking to manage everyday spending, exchange currencies, and invest from their phone. With multiple account tiers, including a free Standard plan, there’s flexibility to choose what works best for your lifestyle. If you’re happy to navigate differing fee schedules and want perks like travel insurance or crypto trading, Revolut could be a good fit.

That said, if you’re after a simpler solution for international spending with no monthly fees, no weekend exchange markups, and a clear fee structure, the Wise account might be worth considering.

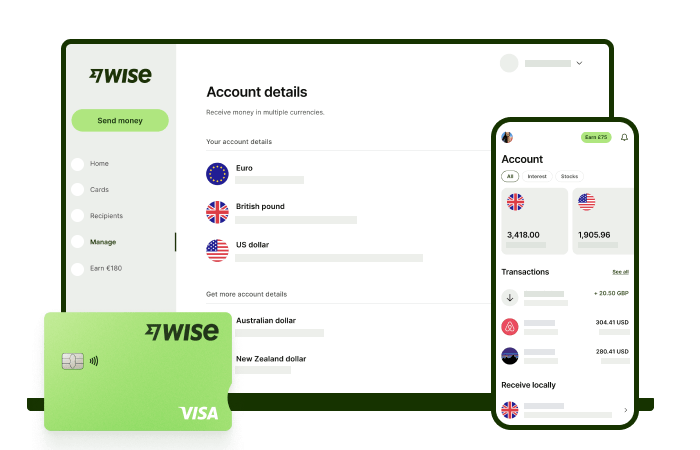

The Wise account is an easy way to save up to 5x when you send, spend, and withdraw money internationally. Hold and manage 40+ currencies, including AUD, USD, EUR, and more. All you need to do is sign up for a free account to get started, there's no monthly fees either.

You can exchange currencies at the mid-market rate on every conversion — basically the rate you see on Google. And with zero foreign transaction fees, and low, transparent pricing, Wise usually gives you the best value for your money.

You'll get 8+ local account details in AUD and a selection of other global currencies to get paid conveniently to your Wise account. And when it's time to send money abroad , enjoy fast, low-cost transfers to 140+ countries. Plus, you can get a linked Wise debit card for spending internationally at the same great mid-market rate.

When it comes to managing money globally, the Wise account is a handy tool that makes it easier and simpler.

This general advice does not take into account your objectives, financial circumstances or needs and you should consider if it is appropriate for you. Savings claim based on our rates vs. selected Australian banks and other similar providers in Jan 2025. To learn more please visit https://income-climb.live/au/compare%3C/a%3E%3C/p%3E

Please see Terms of Use and product availability for your region or visit Wise Fees & Pricing for the most up to date pricing and fee information.

Date: 22 July 2025

*Please see terms of use and product availability for your region or visit Wise fees and pricing for the most up to date pricing and fee information.

This publication is provided for general information purposes and does not constitute legal, tax or other professional advice from Wise Payments Limited or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or guarantees, whether expressed or implied, that the content in the publication is accurate, complete or up to date.

Compare the best high-interest savings accounts in Australia. Our guide breaks down interest rates, and fees to help you find an account to grow your savings.

Thinking of buying property overseas from Australia? Our guide covers the process, how to get an overseas mortgage, and tax implications for Australians.

If you’re looking for a way to send money abroad, especially to China, you may have come across Panda Remit. A relative newcomer among money transfer...

Looking for the best credit card for Velocity points in Australia? We’ve compared the top cards across key factors like earn rates, fees, and more.

Compare Westpac Qantas credit cards to find the best one for you. Our guide covers how to earn Qantas Points, get lounge access, and link your account.

Thinking of transferring money with Revolut? Our guide breaks down their money transfer fees, exchange rates, and limits.